Transforming payments and financial messaging, worldwide for over 30 years

Global coverage of market infrastructures and rails

Payments and financial messages delivered on-time, safely and securely, worldwide

True multi-entity solutions

All payments and financial messages managed and controlled centrally to boost operational efficiency and STP rates

Adaptable through configuration, not customization

No more expensive and risky customizations with agility through self-service business rules

Multiple deployment options

Run the solution as you want - customer or Finastra managed cloud, SaaS, or on-premise, including access to one of the world's largest Swift Service Bureaus

Modern architecture

Our payments and financial messaging solutions are built on our Global Payments Framework (GPF) enabling financial institutions to modernize infrastructure, improve operational efficiency, realize rapid ROI, and drive future innovations

Reliable

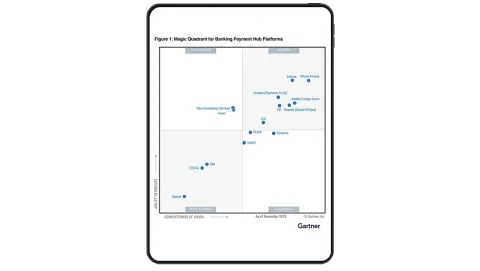

Finastra solutions are globally proven, trusted, and acknowledged as leaders in the field of payments and financial messaging

Whatever your size and need, our integrated payments and financial messaging solutions have you covered.

Payments

Finastra Financial Messaging

Streamlined financial messaging and seamless market infrastructure connectivity

Finastra Bacsactive-IP

Online access to a full range of Bacs and Faster Payments services for UK customers.

Our customers stories

Payments and financial messaging solutions trusted by institutions worldwide for over 30 years

Backed by decades of global payments expertise and thousands of successful implementations, our suite of solutions enables institutions of all types and sizes to drive operational excellence and innovation.

All financial institutions must adapt to stay relevant

Experience the future of payments and financial messaging with Finastra, ensuring reliability while meeting the evolving expectations of customers

Drive innovation and deliver increased business value at pace, with faster Time to Revenue

Our modern architecture delivers a secure, scalable, and resilient platform with lower Total Cost of Ownership

Meet evolving regulatory requirements and timelines with confidence

Choose a partner with industry recognized depth of functionality and experience

Envision what's next - innovate for growth

Instant payments

The list of use cases and extent of global coverage are expanding – whether through regulation or market forces – don’t risk your clients migrating to fintechs.

Cross-border payments

With increasing digital payment volumes, customers expect greater coverage, transparency, predictability, and reliability.

ISO 20022 adoption

Go beyond compliance. ISO 20022 messaging opens a world of possibilities to improve operations and automation. The clock is ticking—how are you responding? See our advice for CBPR+.

Payments transformation

A modern, responsive and resilient payments and financial messaging architecture is essential to meet customer demands.

ACH payments

Modernizing ACH isn’t optional—it’s a competitive necessity. Learn how modern payment hub solutions can drive ACH growth.

Our payments and financial messaging solutions power the global economy

Payments credentials

Customer base

| 300+ | customers worldwide |

| 75% | of the world’s top 20 banks |

| 750+ | Go Lives/year |

Market coverage examples

| 25%+ | US Wire payments |

| 40%+ | US CHIPS payments |

| 50%+ | Australian RTGS payments |

| 50%+ | Swiss CHF payments |

| 40%+ | UK CHAPS payments |

| 15%+ | European T2 payments |

| 50%+ | South Africa direct debits |

Live performance examples

| 8M+ | instant payments/day |

| 70K+ | batch transactions/minute |

| $7T+ | payments value/day |

| 99%+ | domestic STP rates |

| 95%+ | cross-border STP rates |

| 99%+ | availability |

Financial messaging credentials

Customer base

| 3 | Swift Service Bureaus worldwide |

| 425+ | FM customers worldwide |

| 3K | Bacs & Faster Payments customers |

| 625 | Go Lives/year |

Market coverage examples

| 15+ | market infrastructures |

| 30+ | payment rails |

| 50% | Swiss market share |

Live performance examples

| 2M+ | messages processed daily |

| 1M+ | SIC payments processed in the Swiss Service Bureau |

| 99.99% | uptime (FM platform) |

| 100% | uptime (Bacs platform) |

Helpful resources to improve

Payments FAQs

Take your next step toward payments innovation

From strategy to execution, we help you lead the future of payments with modern, scalable solutions. Connect with us to unlock new possibilities for your business.