Discover the world of evergreen features

Elevate your lending services with a customer-first cloud solution, powered by IBM and NTT Data. Streamline operations through automation, strategic partnerships, and outsourced tech maintenance—while benefiting from predictable, outcome-based pricing and unmatched reliability.

Accelerate business agility

Rapidly deploy new capabilities in line with evolving business requirements, to support your growth ambitions

Enhance automation and service levels

Enable seamless integration through AI-supported service delivery and provide robust business support

Best value for functionality

Add extensive capabilities, while reducing TCO and optimizing shared resources

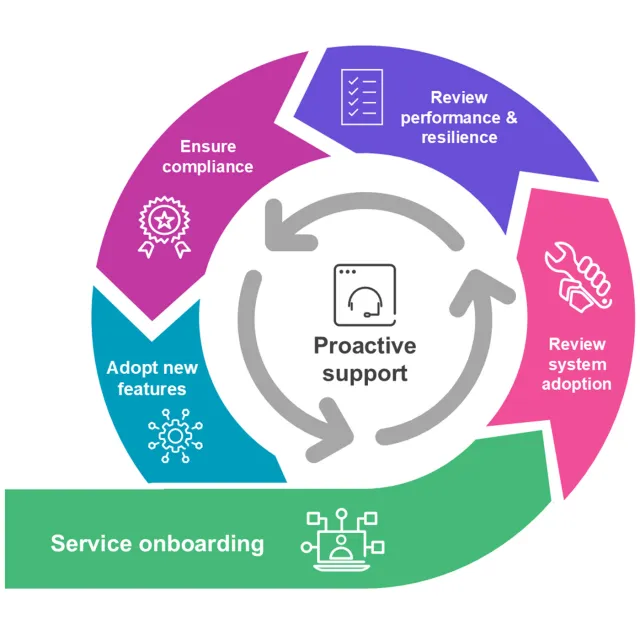

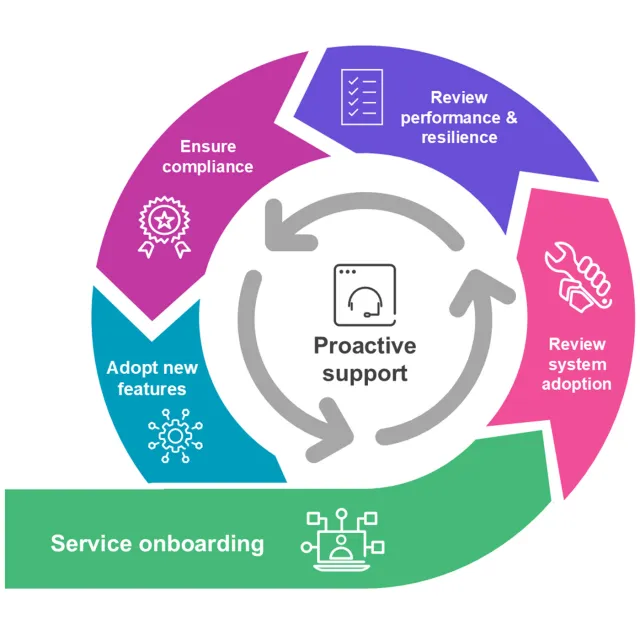

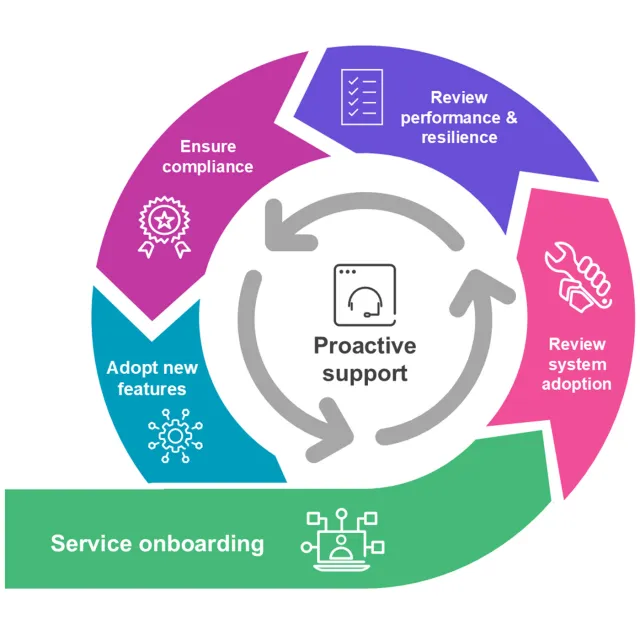

Ensure compliance

Meet the highest standards of security and reliability through proven protocols and certifications

Leverage key capabilities to scale with your business

Our infrastructure, software, compatibility, and compliance standards are continuously upgraded to align with evolving bank requirements and market demands—ensuring your bank stays ahead, remains secure, and consistently delivers value.

- Established lending and trade expertise

- Connectivity via OpenAPIs

- DevOps tools, automated testing and AI driving service agility

Future-proof your technology investments

Build resilience and scalability

Leverage Azure capabilities, unrivalled expertise recognized at international standards, and powerful integrations. Our client focused solution provides evergreen features, continuous service improvement, for greater business agility and resilience. Enjoy the best value for functionality, and robust protection against security and technology risks.

Establish a holistic approach

Leverage our assets, accelerators, and IP to enable a frictionless end-to-end approach with enriched automations that support your ongoing business agility and ultimately transform the customer experience.

Achieve long-term success

Enjoy predictable outcome-based pricing and leverage strategic partnerships for enhanced service delivery and compliance. Achieve greater scalability, improve operational efficiency, and boost organizational capacity with the latest technology, keeping you in the lead.

Discover why our cloud service is key to scaling corporate banking securely and efficiently.