There is no longer any doubt that financial institutions view the cloud as the right way of consuming banking technology. But what are the drivers behind this trend, and why has it become particularly prevalent in recent times?

The main drivers behind cloud adoption fall into three categories: business, technical, and compliance.

From a commercial perspective, banks are still very much on the path to digitalization and looking to benefit from the economics of cloud. Many are currently in the process of reviewing applications to understand which platform will get them to their chosen destination and outcomes.

Simplification and consolidation

As part of this analysis, addressing the business driver, banks aim to identify ways to simplify their systems to create product systems, which perform the specialist job of managing financial products that reflect market and compliance requirements.

A product system can handle these jobs extremely effectively, meaning that banks can leave other ancillary functions, like reporting and risk management, to systems with specialized functions and more suitable feature sets, which tackle all three main drivers.

Ensuring specific systems to specific jobs in the technology landscape is the objective of most architects today. This creates a simpler set of systems to update and is the foundation for better orchestration. This also drives consolidation; instead of having 3 separate systems for bilateral, SME and syndicated lending, banks can have a single system to support all lending.

An additional benefit of consolidation is that it eliminates the need for banks to train their teams to use multiple systems. The prevalence of bank initiatives, including global standardization of processes and procedures, are materially easier if banks are using one system instead of three.

Operational efficiency: A priority for CTOs

Meanwhile, CTOs are under pressure to take cost out of their technology operations, particularly now that banks are earning less from their assets under management.

CTOs also need to free up time to help grow and transform their businesses, rather than using the majority of their resources to keep existing systems up and running.

The increasing appetite for clean data

Another reason to simplify and standardize core systems is that systems using AI to support analytics, regulatory reporting and audit trails - to demonstrate how and when decisions were taken - requires accurate, real-time data.

Part of the responsibility of technology providers like Finastra is to ensure we provide high-quality, reliable decision-grade data that seamlessly integrates into the information flow that is required by various systems, from BI to AI.

This is crucial, especially because we are seeing a growing trend where everyone in the business now demands high quality data to support risk management and ensure integrated compliance.

Most banks we speak to are now considering integrated compliance platforms that draw data from multiple sources – enabling them to look across products, assets, books and customers to ensure they are complying with relevant regulatory requirements.

This trend to have the ability to report across the organization is being reinforced by recent regulations such as BCBS 239, also known as ‘ data must be accurate, complete, timely, and adaptable—especially under stress conditions’.

Introducing Finastra’s Lending Cloud Service

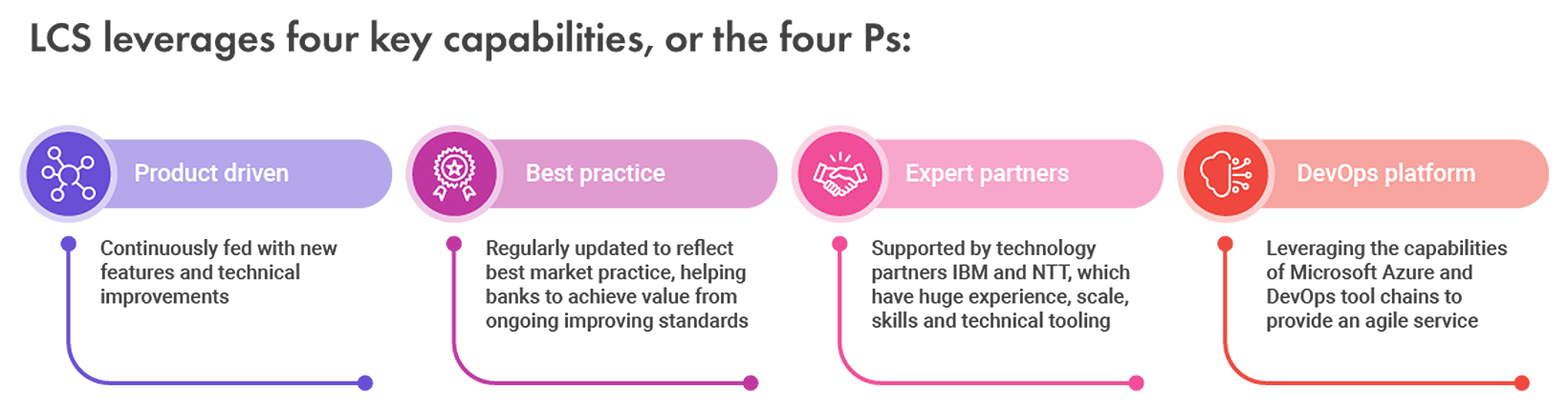

Finastra has developed the Lending Cloud Service (LCS) to help banks address all of the trends above. LCS is a continuously improved agile service of Finastra lending products in the cloud that provides world class, faster lending and trade functionality at an affordable price.

A trusted platform

LCS is the functionality of our lending solutions provided as a cloud service, enabling banks to benefit from their capabilities without the associated cost of supporting and maintaining the applications. It reduces overall TCO while incorporating new features as required and provides a highly agile platform that would be very expensive for banks to develop and maintain themselves.

Connectivity with APIs

A further benefit of LCS is that it includes a raft of rich APIs, enabling banks to connect existing workflows with our lending and trade services, then provide data to ancillary systems, such as AI or regulatory reporting, much more easily and safely.

Consolidation

This approach conforms to the idea that the right systems should be doing the right job inside the bank, rather than banks stretching systems to do things that they are not very good at.

An important part of the move to cloud for banks is to go through an architectural reconfiguration way of thinkin g, or ‘functional decomposition’. It’s an opportunity to simplify and consolidate systems to address higher volumes and provide a scalable solution.

Choosing the right platform

One important factor in banks’ choice of platform is how they will be supported both through implementation and during the day-to-day use of a system. Part of the promise of LCS is that Finastra will conform with evolving data protection rules, market protocols and service standards as defined by industry bodies and regulators.

This regular adaptation to reflect new approaches is part of the service - including the regular communication of these improvements to clients. Users of the service will rely on the fact that the service they are consuming is demonstrably operating at standards above their own internal levels.

LCS enables banks to outsource the complete IT supply chain: from system planning and design through build, test, deploy and then running the system, and ensuring it is available to users all over the world.

The challenges banks face when adopting cloud services like LCS

The biggest challenge that we see is the absorption of the fundamental change to how capability is provided to operators in the bank. Moving from a self-managed model to a hosted solution is operationally challenging, as banks traditionally have teams of people employed to consult, design, change, test and run this complex system and LCS relieves the bank of needing this people. That’s why moving to a new operating model and adopting a mindset where technology updates happen on their own can be a significant upheaval for some.

The second is often ensuring that compliance and security teams are happy that data will be stored offsite in a secure Azure cloud and that the procedures and access controls are in-place, ensuring that the service administration teams have the right data.

Given Microsoft’s substantial investment in data security – significantly exceeding that of any individual bank, we find this is a relatively easy hurdle to get over. But nonetheless it is incumbent on Finastra to prove that bank data will be safe and that only the right people have access to sensitive customer information.

Thirdly, some integrations are likely to have to be re-written because data is now being passed over the internet. We need to use RESTful APIs, and some of the existing integrations may be SOAP or point-to-point integrations. Cloud migration requires rewriting certain integrations, offering banks the opportunity to streamline legacy systems, reduce complexity, and enhance long-term maintainability.

The advantage of working with global partners along with Finastra

Finastra recently partnered up with IBM and NTT to give us more scale and skills, largely because our business has grown, which meant we needed to expand our support footprint.

IBM and NTT are used to dealing with the standards required by different jurisdictions, and can ensure that applications are running effectively, are highly resilient, and can be recovered quickly if needed.

However, our clients still have access to the rich knowledge and experience that Finastra brings to systems such as Loan IQ and Trade Innovation, which provide a great deal of extensibility and customizability.

In summary, LCS provides all of the answers to the challenges that CTOs of corporate banks are facing. At Finastra we understand the necessity of migrating systems to the cloud for TCO reduction and agility reasons, and recognize the advantages of having access to standardized, simplified systems and data. LCS provides a reliable way forward, while ensuring that banks remain compliant with any jurisdictions in which they operate.