Transactions in less than 10 seconds, operating 24/7/365

As the second wave of banks begins the final leg of the SIC Instant Payments (SIC IP) migration, they’re playing a vital role in maintaining Swiss banking global competitiveness. By migrating to SIC IP, banks will facilitate payments in as little as 10 seconds, 24 hours a day, 7 days a week. This shift to instant processing aligns Swiss banks with financial institutions around the globe that have already made the move to real-time payments. While SIC IP promises to revolutionize the way funds are transferred between banks in Switzerland – and significantly improve the customer experience – banks transitioning during Phase 2 could face some critical challenges as the November 2026 deadline nears.

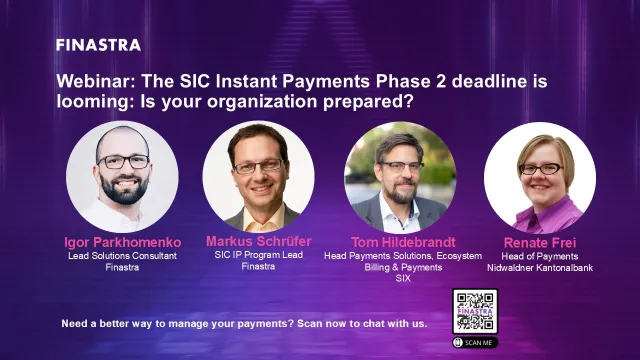

The SIC Instant Payments Phase 2 deadline is looming: Is your organization prepared?

Moderated by Finastra and joined by expert speakers from SIX and Nidwaldner Kantonalbank, this insightful webinar provides essential guidance on how financial institutions can prepare for the November 2026 deadline.

Getting ready for Instant Payments in Switzerland

The November 2026 deadline for SIC IP is coming sooner than you think. To ensure your bank is fully prepared, read Finastra’s latest eBook, which provides step-by-step guidance on how to best prepare for the transition. It emphasizes the importance of scheduling a testing window with SIX as soon as possible, as well as significance of vendor readiness and operational efficiency to enhance competitiveness in the global payments landscape.

The future of SIC Instant Payments begins with Finastra

Finastra is helping banks implement SIC IP in the most seamless and cost-effective way, using the latest technologies to deliver robust sanctions screening and fraud prevention tools. And as our service evolves, it allows banks to respond quickly to changing customer, industry and regulatory demands, thus future-proofing a bank’s technology investment.

Resources

To help you fully prepare for SIC Instant Payments, here is a list of resources to assist your organization in its migration efforts.

Need assistance with

SIC connectivity?

Finastra can help.

Contact us today!