Lending AI expertise

Finastra leverages AI tools to deliver cutting-edge Lending solutions to optimize commercial, consumer, and mortgage lending

Ready to redefine the mortgage experience?

Turn your website into a dynamic point-of-sale channel, deployed on the cloud, and stay on top of compliance through automated 3-day disclosures. Highly configurable to a wide range of mortgage products, Originate Mortgagebot enables you to provide your borrowers with a secure, self-service, complete application experience, white-labeled to your branding.

Deliver superior customer experience

Customers complete 69% more applications online with Originate Mortgagebot

Simplify application processes

Provide automatic pre-approvals and 3-day disclosures and realize 2x the revenue with the same operations staff

Master compliance

Leverage Finastra’s “compliance first” design strategy to better identify and mitigate risk in your lending operations

Accelerate decisioning

Automatically imports and pre-populates credit reporting, MI rate quotes, asset verification, and automated underwriting services

Build more pipeline, close more deals

Seamlessly integrate to partner services

Speed time to close, increase revenue, improve employee experience by creating an automated and accelerated front-to-back ecosystem with our powerful integrations and your vendors of choice.

Scalable as markets evolve

Efficiently accept and process more applications as the market adjusts, including interest rates, housing demand, economic factors, and business opportunities.

Increase efficiency, service and savings

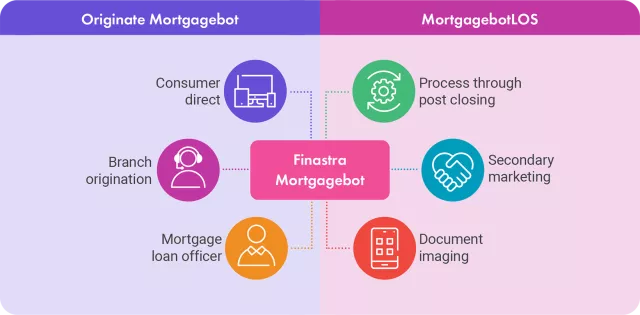

Seamlessly share, edit, and attach documents. Provide borrowers with detailed forms and instructions via DocExchange, and send completed applications directly into Finastra MortgagebotLOS or your preferred LOS for processing, closing, imaging and secondary marketing.

End-to-end and fully compliant

Provide borrowers a self-service and personalized experience with automation to streamline the lending process and close loans faster with the assurance that Finastra’s “compliance first” design strategy helps you mitigate risk in your lending operations

Finastra Data Insights

Enable portfolio growth and maximize back-office efficiency with insightful borrower and benchmarking data.

Unlock valuable insights into mortgage borrower behavior and demographics with Finastra’s Data Insights. Benchmark against over 1,000 Originate Mortgagebot users to enhance your mortgage portfolio’s revenue generation using our powerful, easy-to-access dashboards and machine learning analytics.

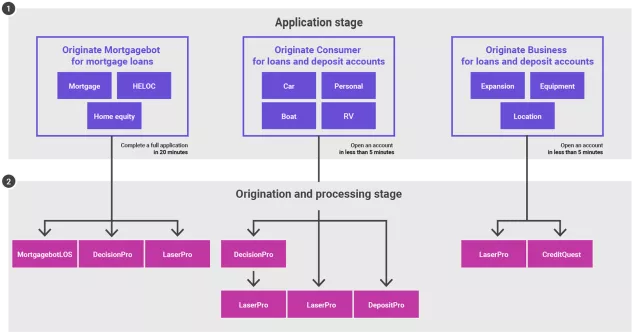

Originate one-stop shop workflow

Originate simplifies and streamlines the account application process and features powerful integration to Finastra and select third-party LOS solutions, each of which integrates with LaserPro, Finastra’s state-of-art compliant loan document engine.

Solution Store from Finastra: Buying made easy

The Solution Store allows existing customers to browse Finastra’s online catalog of product solutions and make purchases with the ease of a few clicks:

- From Compliance Reporter to Data Insights to training, many of Finastra’s state-of-art services are at your fingertips with more being added regularly.

- Enjoy a seamless, efficient experience - when and where it’s convenient.

- Securely purchase services in mere minutes.

Navigating the current (and future) mortgage market

Digital mortgage origination solutions you can grow with