Finastra leads GenAI strategy for financial services innovation

Explore Finastra’s expert insights on GenAI’s role in transforming banking, boosting productivity, and driving smarter financial decisions.

Finastra leadership

Learn about Finastra’s view of emerging AI technologies and how banks can prepare for tomorrow’s competitive landscape

Corporate Lending

AI-inspired design delivers Corporate Lending solutions to support loan servicing, knowledge management, and customer service

Retail Lending

Finastra delivers business and consumer solutions that deploy design thinking to help you excel in today’s hyper-competitive marketplace

Mortgage Lending

Finastra Mortgagebot is the industry’s only true end-to-end cloud-native mortgage lending solution and leads in the era of AI and automation

Real time support

Strategic Engagement, Finastra’s premium support service, powers its inquiry capabilities via a cutting-edge AI engine

Fewer IT resource needs

Corporate Lending meets the needs of today’s complex lending environment by delivering AI-powered capabilities that help lenders prepare to meet today’s complex challenges

Break the language barriers

Conductor Translate leverages the Microsoft AI Language API to deliver loan documents targeted to multi-lingual customers

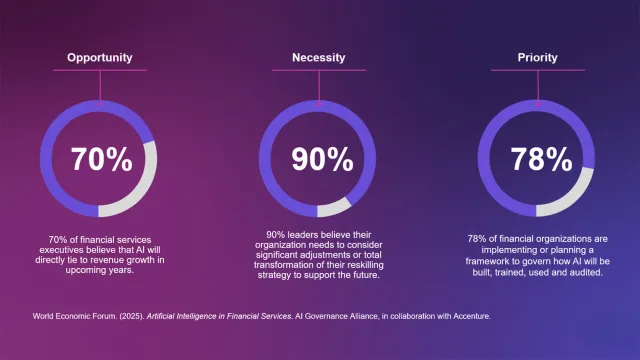

AI is no longer a fringe experiment; it’s the engine of next-generation banking. Customer interactions, loan approvals, fraud detection—even compliance monitoring—are all ripe for reinvention.

Agentic AI drives next-level operational efficiency

Lending workflows are being reshaped by AI assistants that automate complex tasks while managing risk, ensuring accuracy, and improving the user experience. Agentic AI plays a pivotal role in corporate banking, delivering high quality data that improves decision-making and compliance.

Gen AI is reshaping how financial institutions prepare for the future

Gen AI is quickly becoming routinized in the operations of banks and credit unions. Whether developed with internal resources or through partnerships with Finastra or other fintechs, AI tools are enabling financial institutions to make better, faster, and less risky decisions and grow their business.

Finastra’s Lending platforms incorporate AI tools to elevate your efficiency and get results

Academy.AI

Academy.AI helps your team adapt to change with role-based training for LoanIQ and Trade Innovation.

AI Assistant

LaserPro cloud AI Assistant harnesses the immediacy and accuracy of AI to provide instant access to mission-critical information.

Workflow Automation

Workflow Automation and Artificial Intelligence are reshaping the mortgage lending landscape toward a streamlined data-driven journey.

Assist.AI

Assist.AI for Trade Innovation transforms trade finance operations by ensuring users have the information they need right at their fingertips.

Finastra recognized for fintech industry leadership

Best Loan Systems Provider for Retail Banking

LaserPro awarded Global BankTech Awards 2025 - Best Loan Systems Provider

Lendtech of the Year Finalist

LaserPro awarded US FinTech Awards - Shortlisted as Lendtech of the year

Global Finance - Best Trade Finance Providers

2025 Best Trade Finance Provider – Non-Bank

CNBC and Statista’s World’s Top 300 Fintechs

CNBC and Statista’s list of the World’s Top 300 Fintechs—for the third year in a row!

How can AI transform your lending business?