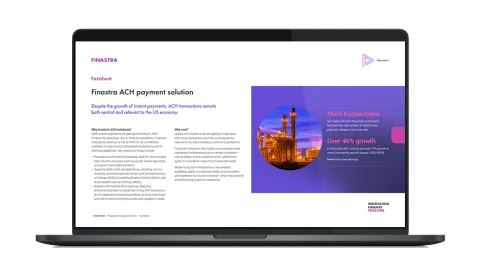

ACH payments in the US continue to grow - how will large enterprise organizations respond?

ACH processing remains a “must have” channel for US Financial Institutions (FIs) as volumes grow and new features are added. Large enterprise organizations, such as global banks and aggregators need a scalable ACH solution to meet the growing ACH volumes.

Default Finastra

As with other payment rails in the current “Perfect storm” of changes in the payments industry, legacy ACH solutions, whether developed by vendors or in house, are feeling the pressure of continued support to cope with increasing volumes and innovation.

- In 2024, Same Day ACH payment volume topped the 1 billion mark, with more than 1.2 billion payments for the year. The value of those payments was $3.2 trillion.

- From 2023 to 2024, Same Day ACH volume soared 45.3%, more than double the growth rate from 2022 to 2023.

- ACH Network payment volume rose 6.7% from 2023 to 2024, to 33.6 billion payments in 2024. The value of those payments was $86.2 trillion, an increase of 7.6%.

Implementation of Finastra’s modern payment hub solution, Global PAYplus, guarantees not only ongoing support for your ACH processing (including compliance with NACHA changes) but the opportunity to transform other rails in line with your business and operational objectives. With Global PAYplus, financial institutions can modernize their payments architecture including supporting growing ACH payments.