Instant payments are no longer optional—they are fast becoming the default expectation across retail, corporate, and cross‑border payments. As volumes surge and settlement windows collapse, banks face mounting pressure to modernize legacy systems while maintaining resilience, security, and regulatory compliance.

Key insights include:

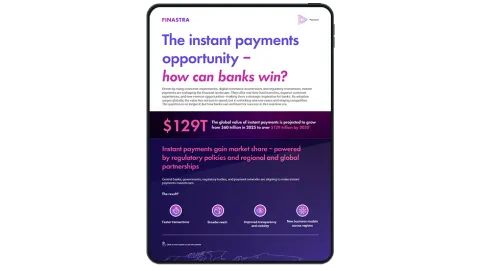

- Why are instant payments becoming a strategic priority for banks across retail, corporate, and cross‑border segments?

- How can banks turn instant payments into a growth engine, while enhancing customer experience and operational efficiency?

- How can banks replace fragmented, legacy payment systems with modern architectures capable of supporting real‑time volumes and volatility?

- From a technology perspective, what capabilities must banks build to support always‑on payments—resilience, scalability, interoperability, and real‑time processing?

- From a strategic perspective, how should banks evolve their payments operating models to drive long‑term growth, differentiation, and competitiveness?

Download the whitepaper to explore how banks can move beyond speed and build sustainable value in the instant payments era.