- The once innovative best-of-breed trading solutions are struggling to keep pace with change

- Placing the securities finance function within the core Treasury and Capital Market book of record can simplify the businesses significantly

- Banks are seeking improved ways of maintaining regulatory compliance in a fast-moving environment

Internal processes at banks have changed in recent years. Many banks now express the desire to have increased control over data environments, and to allow desks to monitor and act centrally throughout their businesses. This has the advantage of allowing banks to free up budgets, improve data quality and reduce their operational risk.

In the securities finance industry, best-of-breed solutions have, for a long time, led the way in helping banks grow their business, by focusing on optimizing a specific function.

What is less well known however, is that the effectiveness of these solutions has diminished in recent years. Their narrow breadth of functionality, coupled with their lack of integration, while once not a major issue, is now stifling banks' abilities to streamline and adapt. This is hampering efforts to do more with less in an increasingly interconnected and regulated industry.

In addition, and perhaps most importantly, these solutions often lack comprehensive risk management, analytics and automation tools, which have become increasingly important as banks look to manage both increased regulatory costs and provision of inventory and liquidity.

Legacy best-of-breed solutions then, have become outdated. In order to save costs, banks are increasingly looking to adopt an overarching solution that delivers a greater analytical framework for front- and middle-office risk management consistent with other business units, and higher automation between the front- and back-office.

A deeper look at the challenges faced when using current solutions

Like many other businesses, securities finance is a “front-to-back" office activity. However, unlike most trade types, the relation between front- and back-office is bi-directional. Securities finance can be considered a “back-to-front” activity because back-office settlements influence the decisions made in the front-office. Therefore, a settlement-aware inventory – i.e. one based on real settlement messages (the back-office view) as opposed to one based on trades’ theoretical settlements (the front-office view) – is critical. Also, trade pricing methodologies considering settlement failures are of fundamental importance on securities lending.

Best-of-breed solutions were designed to cater to the front-office, computing P&L of securities finance trades based on accruals. However, strong back-office integration was often lacking. The notion of present value was absent, or very limited, and analytics (also known as Greeks) were incompatible with regulatory standards. Therefore, to resolve this issue, a state-of-the-art pricing and analytical framework is needed, along with a multi-curve bootstrap capability, which allows a proper market data sensitivity calculation.

In addition, physical (Repos/SLB) and synthetic (TRS) securities finance desks trade on the same inventory, thus requiring a shared view of the inventory. This creates a need for a holistic view of positions, made of outright (securities buys/sells) and securities finance trades (both physical and synthetic). Current best-of-breed systems only provide a view limited to physically settled trades and cannot handle synthetic trades.

The future for securities finance

To solve these challenges, the trading solution must have three main features: inventory management, automation and integration.

By integrating the business into the banks' core platform, the bank achieves the insight across desks, and automation required for back-office tasks, from settlements to documentation and exceptions within a straight-through-processing (STP) framework. This level of integration also ensures compliance in an ever-changing regulatory landscape, like SFTR for regulatory reporting, or FRTB and IRRBB for regulatory risk.

Repetitive front-office tasks associated with securities finance — like securities transfer between books or custodians — can be carried out by a customizable and automatable framework, saving time for end-users and reducing operational risk.

These features result in a simplified architecture, whereby one central system defines all securities statics, delivering cost-effective reconciliation.

Finally, with these attributes, counterparty relationships can be simplified across the desks: a centralized view across trading desks is provided, with unified P&L, risk and collateral per client — fostering collaboration across business lines.

A solution that can deliver all these benefits will be a real game-changer for securities finance desks. Such a functionality-rich core trading solution will support business growth, improve STP, and reduce internal costs while significantly simplifying the architecture.

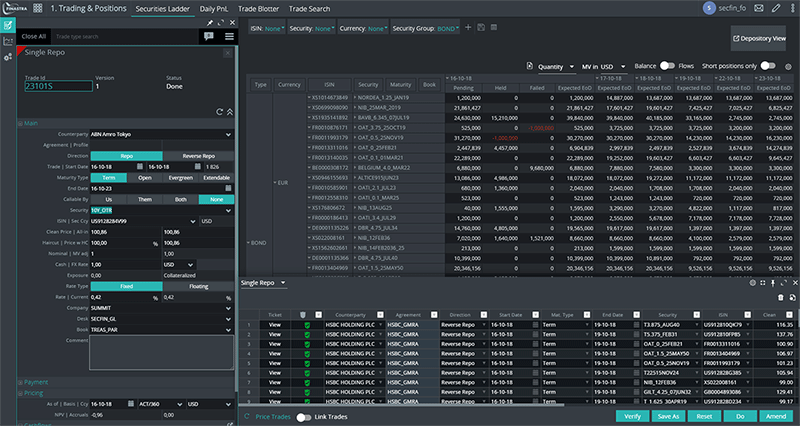

Fusion Market’s securities finance workstation, showing positions monitoring and trade capture (single and bulk)

Fusion Market’s securities finance workstation, showing positions monitoring and trade capture (single and bulk)

Finastra’s Fusion Markets provides all the capabilities banks need for fast, effective securities finance operations - across the front- and back- offices. For more information on our securities finance solution, contact us here.