Payments may seem simple to outsiders, mainly because they have been around a long time, allowing the main challenges to have been overcome. Arguably many aspects have not changed much; for example, how a payment is submitted still largely defines the payment rail used, the processes applied, and where and how it is settled. This was as much a technology problem as a payments problem. In 1977, to create Swift as we know it today, the boundaries of technology at the time were pushed.

Today, the world is quite different. Payments are a key part of how banks compete – not just on price but on experience, choice, visibility, transparency, etc. The move from being seen as a cost centre to considering payments as a valuable tool in the bank’s proposition is changing how banks think about payments. And now technology and competition are both enabling and driving significant change as a result.

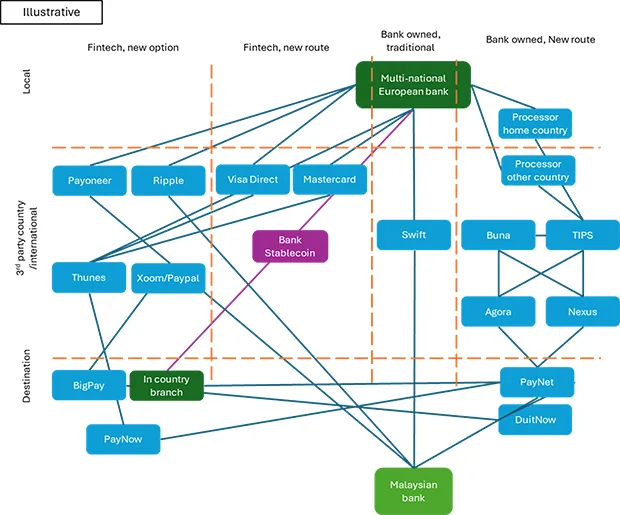

This is likely to be even more visible in cross-border payments, where there is now a list of choices that are growing almost daily, both in number and complexity.

As a result, while cross-border payment volumes have been growing for many years, they have often been reserved for a small number of major banks. While not every bank will want to enter the cross-border market, technology and the plethora of new rails does give many more banks the option to do so, should they wish.

Financial institutions have a plethora of choices already

The figure above is a simplified illustration of how complex the choices are already. It is far from complete, with more options and vendors not shown than shown. Banks need to move their thinking away from “is this the replacement for Swift?” to more a mindset that they need to support (and if necessary, remove) more rails going forward. With the pace of change of technology, there are likely going to be more and more rails and possibilities going forward. Waiting for one single winner to emerge is likely to mean that banks miss opportunities today. Indeed, it is highly unlikely that one solution, at least in the short term, would ever try to be “all things to all people.” That will simply never happen. Instead, banks should identify those areas that present the greatest opportunity. Those opportunities could present themselves in many ways – cost savings, efficiency, transparency, access to hard-to-reach markets, features, and settlement speed.

There are two ways then that banks need to think about this.

First, there are many benefits to be had. Banks can capture the opportunity that cross-border payments bring. This isn’t just FX related. Technology and the new rails are democratizing cross-border payments. It is no longer the realm of just the very largest global banks, who operate in dozens of countries. This means greater opportunity for the mid-market for client acquisition and retention, along with a larger share of wallet.

Any business case though is never just about the revenue but also costs. A new, modern platform could bring significant cost savings on domestic payments as well, especially when the banks factor in the cost avoidance going forward of always being on the latest release if they choose a PaaS solution. Yet even if they choose an on-prem solution, there are still benefits, especially if that solution is modern, and has been re-architected to use cloud-native technologies and processes. In short, investing in new technology should have lower cost of ownership regardless of deployment model.

As a result, with the right technology and platform, it arguably puts smaller (in comparison to the multi-national giants) banks in a better position, as they have less costs and legacy to manage. Cross-border payments become a “levelling up” opportunity for those banks, who can now challenge in specific markets, corridors or use cases.

This leads to the second way banks need to think about this. If this democratization allows more banks to compete, what is the cost and risk for not doing this? While many banks have wished to upgrade technology, without a compelling business case or regulatory requirement, many have had to be content to be on par with their peers. This brings the risk of them not being competitive or differentiated anymore, while the competition sails past with advancements and technologies necessary to serve their customers. Indeed, if a bank chooses the right technology partner, who likely has those larger banks as clients, they may get significant additional help in addition to the technology, putting their peers in a less competitive position.

Increasingly, doing nothing won’t really be an option.

Download full report on cross-border payments: Preparing for the future of cross-border payments: An action plan for banks