Leveraging advanced technologies

Core Banking transformation

Devoid of legacy code, fully API enabled with inbuilt banking processes deliver optimal STP levels

Data & analytics

Decision can be made based on detailed insights into products, customers, branches profitability

Lower costs. Greater compliance.

RegTech empowers banks to adapt and comply to new requirements & changes with greater ease

Platform & ecosystem

Open banking and APIs are essential parts of digital strategies & the main way to grow an ecosystem

Cloud first

For operational efficiency, agility, risk reduction & cost savings without compromising compliance & security

Digital engagement

Banks can offer high levels of personalization and lifestyle banking capabilities

Core Banking solutions for a fast-evolving market

Hear from our customers

Unlock next‑gen potential with an open, cloud‑first core

Whether you're a challenger or an established bank, Essence helps you accelerate transformation, enhance agility, and build for what’s next.

Less physical. More digital.

Open banking improves customer experience

Customer insight

Integrated analytics generate valuable customer insights

Future-ready

Open, flexible SaaS platform allows innovation and growth

Compliance and speed

Latest innovations ensure compliance & rapid time to market

Open and agile Core Banking platform

Core banking systems that have the breadth of functionality to handle all your banking requirements

- Maximize operational efficiency

- Reduce Cost-to-Income ratios

- Consumer-centric focus

Ready to innovate?

Build the foundation for next‑gen banking success

Replace your core for growth and agility

Embarking on a core banking modernization project need not be overwhelming. Choosing the right technology partner can make the seemingly impossible, possible. Not only does the right partner understand your business, your starting point and you destination but they will provide the most appropriate way to help you get there.

Want to know more about your options? Are you ready for digital transformation with a next-gen core?

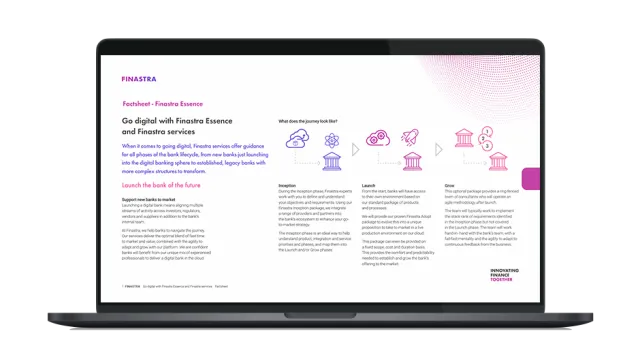

Go digital with Essence & Services

When it comes to going digital, Finastra Services offer guidance for all phases of the bank lifecycle, from new banks just launching into the digital banking sphere to established, legacy banks with more complex structures to transform.

Turn industry challenges into growth

What if the greatest threat to your bank’s future isn’t disruption from outside – but inertia within? In our last Reimagine Banking series, we challenged leaders to envision a new era for financial services. Now, the stakes are even higher: customers can switch providers with a tap, and new competitors emerge overnight. The real risk is standing still. The banks that thrive will be those that turn pain points into launchpads for growth, resilience, and transformation – delivering what customers want, at a price they value, and a cost that drives profitability.

Helpful resources to improve

Apps to extend your core banking solution

Explore apps designed to complement Finastra Essence and extend core banking with payments, connectivity, data and innovation services.

Frequently Asked Questions

Your partner in next-gen banking

Discover how Finastra Essence helps you embrace next‑gen banking, boost agility, innovate faster, and deliver customer delight.

With Finastra we’re disrupting the financial sector in the Philippines and bringing banking to millions of people.