Multi-rail payment processing in a single unified solution

Reduce operations complexities and costs

Consolidate and manage all payment rails operations on a single, modular, cloud-native, intelligent payment hub.

Future-proof your payments infrastructure

Rapidly embrace emerging payment market developments and ensure compliance with future regulatory and scheme changes.

Accelerate service innovation and growth

Ride the next wave of innovation and new banking models through our Open APIs and microservice-based architecture.

Be ready for the new age of streamlined digital payments

Whether its Open Banking, real-time payments, or Crypto developments – meet the ever-changing needs of your customers with speed and efficiency on our intelligent payment hub solutions

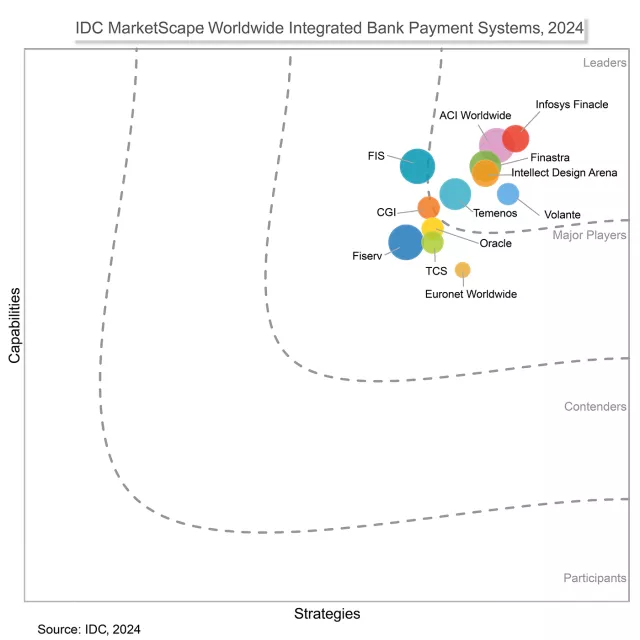

Finastra is named to the leaders' category in 2024 IDC MarketScape for integrated bank payment systems

We are proud to be recognized as a leader in the 2024 IDC MarketScape for integrated bank payment systems. Serving over 300 clients in more than 50 countries, Finastra provides modern payments, ensuring peace of mind for our customers as they manage mission-critical payments. Our scalable and resilient platform offers flexible implementation options and is highly configurable to meet financial institutions' operational needs by integrating best-of-breed providers.

Need support for Instant Payments? Finastra has the answer

Complexity. Simplified.

Remove the burden of maintaining legacy payment silos whilst streamlining payment workflows and future proofing your payment business.

Control

Intuitive dashboard and reporting wizard for obtaining insights and analysis on service performance and operations

Evolve

Flexible on-prem or on-the-cloud deployments and managed services options to meet your specific business and operational requirements

Innovate

Integrated with FusionFabric.cloud – our growing, open ecosystem platform of innovative specialist partners’ applications

Payments Awards showcase

Spotlight on trusted, field-proven, industry-recognized, and award-winning payments and financial messaging solutions

Selecting a Payment Hub

Read this Omdia report to discover the potential of payment hubs and why microservices-driven composable payment systems are the future for financial institutions. Gain insights from real-world implementation examples and the key factors to consider when modernizing payments architecture, including choosing the right vendor and laying a foundation for continuous growth and innovation.

Why can’t payments modernization wait?

Our infographic explains the global impact of modernization on payment operations and the key factors that help banks in choosing the right payment solution to meet their payments modernization goals.

Leveraging the benefits of ISO 20022

Learn how to embrace the changeover from the legacy MT messaging standard to the data-rich ISO MX standard to unlock new opportunities in payments.

-

Finastra Global PAYplus

Deliver modern payments with peace of mind.

-

Finastra Payments To Go

Payment transformation made easy

Modernize payments without breaking the bank: How U.S. institutions can go real-time with confidence

Fincom.co's AML Screening

Fincom.co’s Real-Time AML compliance solution uses purpose-built, supervised Machine Learning with “Phonetic Fingerprint” technology. It allows for screening high volumes of transactions at low latency, from multiple languages and industries, while dramatically reducing false positives without missing hits.

Unlock the power of our payment hubs today