Meet the needs of today’s complex and competitive lending market

Streamlined loan servicing

One system to manage your entire lending book with a consistent operating model for a superior borrower experience.

Accelerate innovation

Seamlessly integrate Loan IQ with the wider financial ecosystem to assemble a cutting-edge lending platform.

Customer-focused solutions

Our technology supports your ambitions to accelerate growth and launch products fast to stay ahead of the market.

Make faster, better-informed lending decisions

Speed up loan decision-making and manage risk with a unified, real-time view of exposures.

Scale with control

Built-in guardrails and automation eliminates manual processes and reduces risk.

A comprehensive suite of lending solutions

Providing the tools needed to optimize your lending business

Unrivaled depth and breadth of functionality to support all your corporate lending needs..

Unified lending platform

Manage all loans, from simple to complex, on one system.

Improve risk management

Consistent data model, centralized view of credit exposures, embedded guardrails, process automation.

Superior borrower experience

Faster turnaround times and consistent processes with self-service capabilities.

Seamless integration

Easily connect to the lending ecosystem to quickly innovate and adapt to changes in the market.

Open up opportunities to innovate

Transform with digital lending solutions

- Automate processes

- Eliminate manual administrative tasks

- Accelerate straight through processing

An integrated lending solution to cover all aspects of the loan lifecycle

Loan IQ

The world’s most trusted corporate and commercial loan servicing platform.

Loan IQ Simplified Servicing

Streamline SME/bilateral lending with the world’s most trusted loan servicing platform.

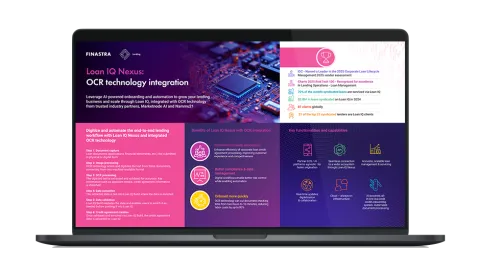

Loan IQ Nexus

Creating a connected lending ecosystem.

Loan IQ Build

Automating onboarding for bilateral and syndicated loans via open APIs.

Loan IQ Transact

Streamlining loan servicing through integration and automation.

Additional resources to support your success

Featured Apps

Corporate Lending FAQs

Redefine corporate lending with Loan IQ

Discover how Finastra can provide the capabilities needed to unleash your lending business.

Loan IQ is a market leader and continues to be a market leader when it comes to process transactions and handling of complex deals.