This article is the last in a four-part series authored by Michael Dowthwaite, Chief Operating Officer of Finastra’s Lending Business Unit, exploring how strategic service models in corporate banking technology can help banks unlock long-term value. You can read the previous articles on choosing the right deployment path, building a future-ready workforce and strategic support models on our website.

Modern banking technology creates real value only when it is paired with a services model that supports the bank from initial licensing through long-term adoption. The earlier articles in this series explored how deployment choices shape outcomes, how capability building turns technology into results, and how strategic support unlocks capacity for innovation. In this final article, I bring these elements together into a unified framework designed to sustain value over time.

Core principles

Agility

Banks operate in changing markets and regulatory environments. The service model must help them adopt quickly – whether they choose to run platforms themselves, collaborate with a partner, or adopt a managed service. Agility comes from clear goals, fit-for-purpose deployment, and a cadence that keeps systems current without disrupting day-to-day operations.

Continuous learning

Technology value grows when people grow with it. Role-based training, ongoing enablement, and intelligent learning tools build internal confidence and expertise. This reduces underutilization, shortens time to value, and makes new features easier to adopt.

Partnership

The most effective support model is collaborative. Vendors and banks share the plan, the risks, and the outcomes. That partnership matters most from point-of-sale to go-live, when strong governance and enablement prevent delays and set a foundation for future releases.

From deployment to innovation

A successful first deployment is the start, not the finish. In the first article, we set out three deployment paths – do it yourself, do it together, and fully managed in the cloud – so banks can align control and flexibility with their goals and capabilities. The right choice reduces cost, complexity and risk while preserving the ability to evolve.

Once live, ongoing support and training fuel continuous improvement. Proactive health checks and performance tuning prevent issues and protect capacity. Structured training programs and platforms like Academy.AI keep teams current and confident, enabling banks to adopt new features at speed and scale.

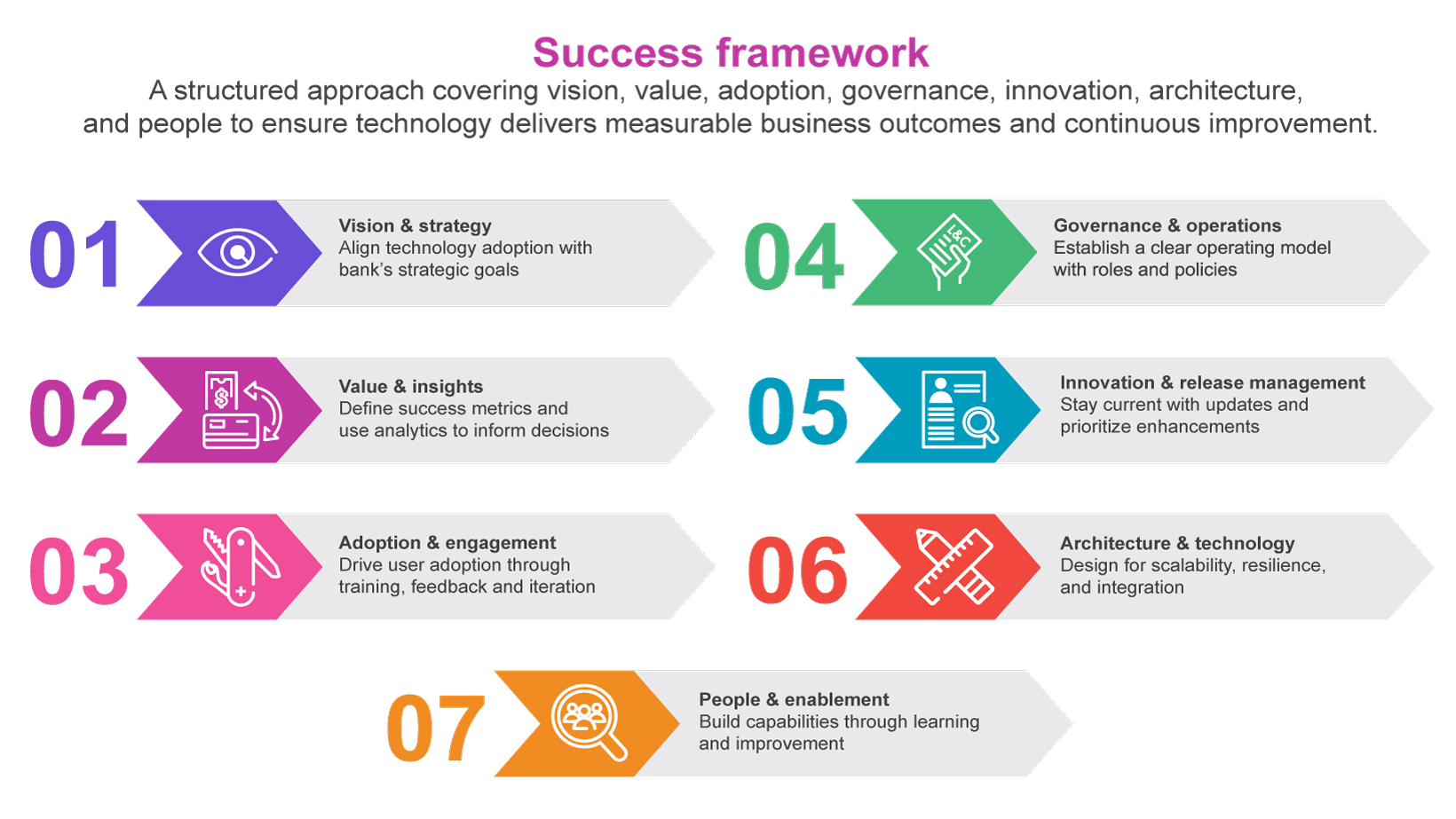

The framework for success

Our service philosophy is organized around seven areas that together describe what success looks like in banking technology:

- Vision and strategy

Algin technology adoption with clear goals such as faster time to market, lower total cost of ownership, and scalable software across segments. Define measurable success criteria and secure executive sponsorship across business, risk, operations, IT and compliance. - Value and insights

Be explicit about how value is created, then track it. Use KPIs like cost per loan, deployment speed, system availability, and error rates. Leverage analytics to guide portfolio decisions and optimize products. - Adoption and engagement

Drive user adoption with change management, role‑based training, and tailored onboarding. Gather feedback after go‑live and iterate user journeys to improve usability. - Governance and operations

Set up a clear operating model. Define roles (for example, a Lending Cloud Centre of Excellence), control configuration and data stewardship, and enforce policies for compliance, security, and scalability. - Innovation and release management

Stay current with continuous updates and features. Prioritize enhancements by business impact and regulatory need and use a disciplined release path from sandbox to production to minimize disruption. - Architecture and technology

Design for scalability, resilience, and integration with core banking, risk, KYC, CRM, and external data via APIs and events. Follow best practices for security, performance, disaster recovery, and data partitioning, and keep the door open for AI, open banking, and real‑time analytics. - People and enablement

Build a capable internal team – architects, administrators, developers, and analysts – and invest in training and certifications. Encourage cross‑functional collaboration and a culture of continuous improvement.

This framework gives banks a practical way to assess readiness, identify gaps, and co-author a plan that turns software into sustained business outcomes. It also creates a common language for how we work together over time.

Enabling long-term success

Long-term success comes from steady iteration: regular updates, feedback loops that inform design and training, and a release cadence that balances control and speed. Data and insights guide decisions on prioritization, performance and risk. With proactive support, the cost and impact of incidents fall, and the team can focus on new products, better experiences, and strategic initiatives rather than recurring fixes. That is the shift from “keeping the lights on” to continuous innovation that I emphasized in the previous article.

Conclusion

A holistic service philosophy for lending technology is simple in intent and disciplined in execution. It starts with a clear vision and the right deployment path, builds capability through continuous learning, and protects capacity through proactive, collaborative support. With these elements in place, technology remains responsive to change, partnership stays strong, and improvement never stops. That is how banks turn deployment into durable value and sustain growth over time.