Why leading financial institutions choose Finastra’s Loan IQ

Increase front to back efficiency

Accelerated deal setup that streamlines onboarding, delivering a 20% reduction in booking times.

Reduce technology cost

50% reduction in integration costs via a consolidated loan platform with an open design

Enable growth at scale

Doubled business with no added headcount, powered Loan IQ's market-leading technology

Improve risk management

Increased automation and built-in controls reduces errors and manual intervention

Grow, optimize and automate with our leading corporate lending loan software

Streamlined workflows

Optimize operating models with a centralized, standardized approach across all business lines based on best-practices through our Loan IQ software.

Reduced TCO

Simplify system architecture with a global platform-based lending solution that reduces hardware costs and simplifies technology infrastructure.

Accelerated revenue growth

Expand customer base with a large breadth of lending products to meet customer needs and attract new business.

Merged all-in-one capabilities

Expand customer base with a large breadth of lending products to meet customer needs and attract new business.

Academy.AI

Unlock the full value of Loan IQ with Finastra's expert-led learning platform

Academy.AI delivers contextual, role-based training through a mix of self-paced modules, hands-on exercises, and instructor-led sessions. Designed for both business and technical professionals, it helps teams close knowledge gaps, accelerate onboarding, and confidently navigate complex lending workflows.

Extend the capabilities of Loan IQ with these complementary solutions

Loan IQ Nexus

Creating a connected lending ecosystem

Loan IQ Nexus is Finastra’s market integration layer that simplifies connectivity and interoperability across internal and external platforms, enabling seamless data exchange, reducing technical complexity, and unlocks faster innovation.

Loan Portal

Streamline corporate lending with real-time data and self-service

The Loan Portal is Finastra's next generation of digitized self-service. The portal integrates with Finastra Loan IQ out-of-the-box to empower corporate clients with the flexibility to access real-time loan data across multiple channels, while securely communicating with loan officers and initiating transactions.

Data Propagation Tool

Flexible data management for smarter governance, not just archiving unused data

The Data Propagation Tool helps financial institutions streamline data governance by archiving, deleting, segregating data across environments, while aligning system configurations and secure data transfer. It improves system performance, reduces TCO, and supports compliance with privacy regulations, making data management more efficient and secure across the loan lifecycle.

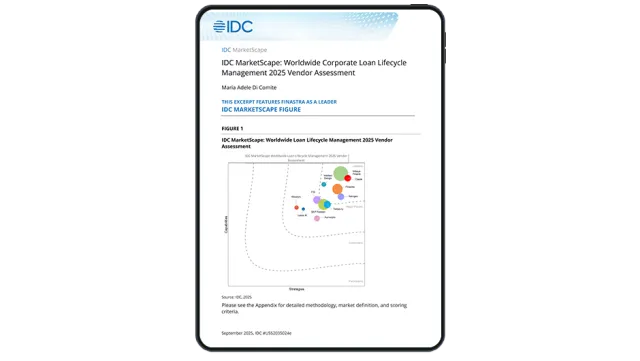

IDC MarketScape: Worldwide Corporate Loan Lifecycle Management 2025 Vendor Assessment

Finastra's Loan IQ was recognized as a Leader in the IDC MarketScape 2025 for its excellence in corporate loan management.

Deliver a superior customer experience with Loan IQ and strengthen operational efficiency

Additional resources to support your success

Loan IQ FAQs

Proven results that matter

Find out more about our Finastra Loan IQ solution

Loan IQ is a market leader and continues to be a market leader when it comes to process transactions and handling of complex deals