Finastra TV

INNOVATING FINANCE TOGETHER

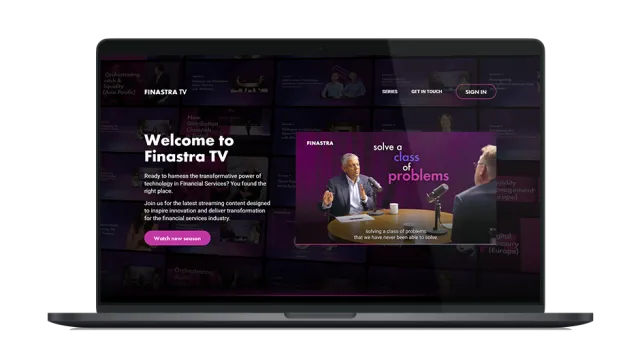

Finastra TV is where you will be able to harness the transformative power of technology in Financial Services, and inspire innovation and deliver transformation for the financial services industry.

Finastra TV

INNOVATING FINANCE TOGETHER

Finastra TV is where you will be able to harness the transformative power of technology in Financial Services, and inspire innovation and deliver transformation for the financial services industry.