- Securities inventory is not just a back-office issue: traders should be “settlement aware”

- With an aggregated, real-time view of inventory, traders can spot opportunities and increase returns

- “Securities inventory as a service” also opens the potential for AI to improve allocation

Decisions in securities finance depends on data from inventory, yet the front office rarely has the view it needs. The “as a service” model for securities inventory creates a bank-wide view that can improve decision-making and returns.

Most legacy systems typically build a theoretical “front-office” view of inventory from trades, ignoring the settlement status of securities movements. The “back-office” view usually only relies on settlements, which are followed at the account level. As reconciliation of inventory is a back-office function, there is a tendency to view securities inventory purely from the perspective of the back office, seen as the gatekeeper of a “real” inventory.

However, considering that most decisions in the securities finance area use data from the inventory, it’s essential that traders are settlement-aware when covering both short and long positions, and can drill down to components of their inventory to identify what portion can be considered as ‘available’, re-used or pledged, etc.

This requires a dual focus that includes both the front- and back-office data: it is a view that is essential for fully informed decision making.

Inventory must source data from different channels

Another challenge is to provide a comprehensive view of inventory. Information usually sits in different systems (e.g. bonds or equity) or is not even integrated into legacy platforms as it comes from external parties such as triparty agents or custodians, and should be re-initialized daily. Today, because traders don’t have full visibility over securities, they often exercise unnecessary caution when trading to maximize return on inventory.

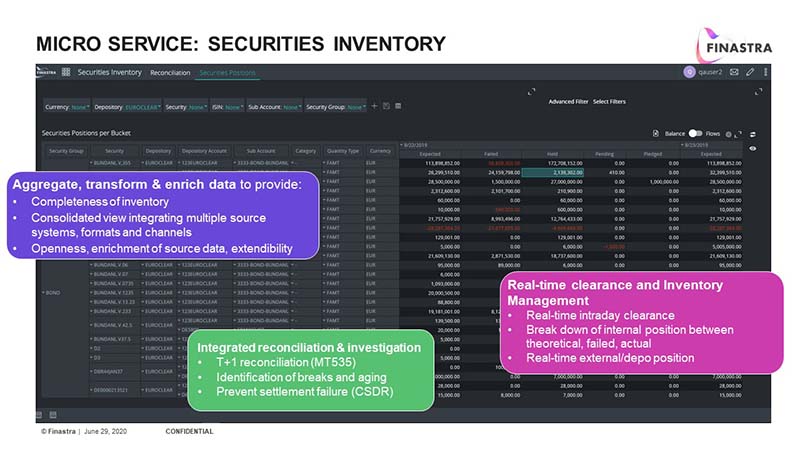

For a complete view of the available inventory, you need to integrate, transform, aggregate and enrich multiple sources of data into a common inventory model that acts as the backbone of securities finance activity.

To provide better front-to-back alignment, Finastra has developed the concept of “securities inventory as a service”. Offering an aggregated view of inventory built from multiple sources and channels, it is designed to be shared between back, middle, collateral and front office functions. One single and central source of truth can now be shared within the bank.

Real-time settlement view maximizes returns

The need for accurate securities data is paramount in helping identify opportunities that could bring in additional income. This isn't possible with a theoretical inventory view. Only through real-time inventories can traders identify the proportion of their flow that is real, and mitigate the risk of being short. Otherwise, to avoid lending a security they are not sure to detain, they are likely to be over-cautious and even miss this opportunity.

Securities inventory provides real-time status of daily settlements, daily reconciliation capabilities with external custodian statements, notification of any breaks and identification of root causes for back value movements or differences between the internal balance and the custodian statement/external balance. This service also gives users the flexibility to look at different types of position (internal real/theoretical/failed, external real-time) so they have the most accurate list on which to work.

Finally, this real-time view helps traders manage securities grouped in liquidity pools. A classifier identifies each security, supported by data enrichment, for instance, HQLA (high-quality liquid assets). This also gives traders the freedom to move around liquidity pools. If a balance sheet requires a certain amount of the liquidity to be frozen, securities inventory must enable traders to identify this centrally.

Flexible data views

Using the securities inventory, traders have access to flexible, pre-defined data views that reflect Finastra’s understanding of the workflow and are quick and easy to implement. Options including a balanced view and a flow view, which enable users to consider availabilities (front-office) or the flows coming in and out (back-office). For example, users can see the theoretical position expected at the end of the day between what's settled, what's failed, and what's pending.

Clicking on a security gives a drilled-down view of the contributors of that security, the trades that contribute to the current position, and future flows. The inventory also allows traders to estimate their pool by knowing the market value of their positions depending on the closing price of the security. This market value either can be expressed in the security currency or in a reference currency so all values can be aggregated.

The time horizon can also be adjusted as required, and projected positions can integrate the callable options of the trades, including asymmetric notice periods for evergreen transactions.

What does all this mean?

These decision-making indicators help traders in their daily activities. Combined with the view of the bank and, at times, external parties, they can increase returns for traders. This is particularly true for asset managers or owners of securities willing to enhance their return by allowing the bank to trade them.

What does the future hold?

Prediction is the next step. AI capabilities could monitor patterns to determine the portion of the day during which the inventory can be considered as actual. This would allow a better allocation of securities.

An evolving securities inventory solution that can deliver all these benefits offers unparalleled data access. Through openness, flexibility, and data enrichment, decisions can be made with confidence, generating higher revenues while mitigating risk.

Finastra’s Fusion Markets provides all the capabilities banks need for fast, effective securities finance operations - across the front- and back- offices. For more information on our securities finance solution, contact us here.