- Results from our survey of banking treasurers showed that many coped well with the transition to remote working

- However there was clear regional disparity between Europe and Asia/MEA

- The blog explores the reasons behind this, along with areas of particular challenge faced by banks

In June, Finastra surveyed treasury departments across Europe, Asia and the Middle East and Africa (MEA) to learn how the COVID-19 pandemic has been impacting their operations.

Feedback confirmed one thing that many of us know: banks have coped relatively well with the rapid switch to remote working. One-third of the organizations we spoke to confirmed that over 75% of their treasury employees were working remotely. And 60% of treasuries were able to quickly organize themselves to have teams rotate between remote working and being located at either the bank or its disaster recovery center.

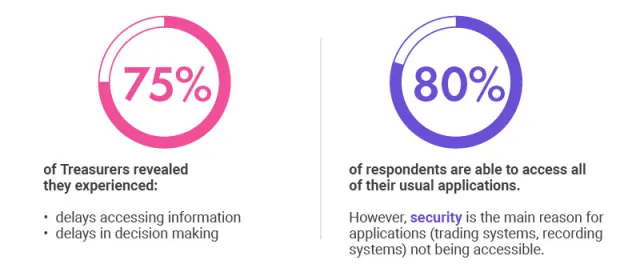

Overall, respondents confirmed that their software was set up for remote access, with 80% reporting that they retained access to their usual apps. Systems proved to be relatively flexible: over 50% of banks were able to maintain all their treasury applications remotely.

We did, however, see a clear regional split. Of the banks with a majority working remotely, 86% were from Europe, with the remaining 14% based in Asia and MEA. Over half of European banks faced no issues at all switching to remote working, yet only 16% of Asian and MEA banks experienced a trouble-free transition.

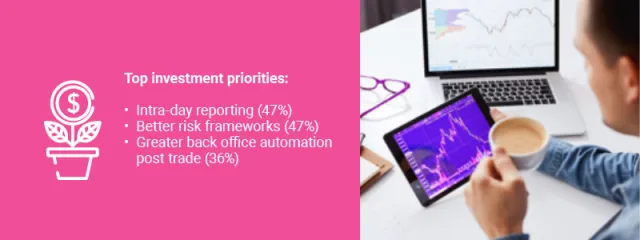

This regional disparity was also reflected in responses around cloud technology, seen by 80% of Asian and MEA banks as the solution to the infrastructure and access-related issues. Conversely, only 20% of European treasuries were looking to the cloud to resolve their access issues, suggesting they are ahead on this part of their technology modernization journey. European treasuries are instead focusing on improving intra-day reporting and their post-trade and risk frameworks.

Reflecting on the fact that some central banks have loosened regulations during the crisis, over 80% of respondents saw trading and post-trade functions as far more critical than balance sheet and stress-testing capabilities. That said, 50% of treasury professionals see the need to invest in improvements in real-time, or near real-time, access to their risk and reporting frameworks, perhaps prompted by the lower levels of speed and granularity available when working remotely.

Other reasons behind the desire for improvement in this area may lie in the relative lack of collaboration that results from a remote working environment. This increases dependence on automation and timely or readily available reporting – all of which ensures stakeholders are aligned.

Unfortunately, however, current back-end systems are not yet advanced enough to support intra-day reporting and a high degree of STP or automation; hence the desire for investment in this field.

While treasurer’s move to working remotely has been relatively smooth, European treasuries are nonetheless suffering from a lack of integration between the front and back offices. Their pre-crisis strategy of seeking best-of-breed solutions for specific areas means it is hard to generate an all-important “golden source” for data. Post-COVID, there is likely to be renewed focus on consolidating treasury system for better-quality decision-making.

During the crisis, treasuries everywhere have struggled equally with security and infrastructure. Over 75% pointed to these issues leading to delays in access to information and decision-making. Trading and reporting systems in particular were the subject of security concerns.

What of the future? In some areas, respondents saw little change despite the crisis. For example, there were mixed and inconclusive answers to our questions about whether treasury departments will be organized differently from now on, with 42% of respondents saying they thought it would be best to pursue a centralized model, while 26% preferred a de-centralized model and 32% felt the current organization is fine.

However, a strong two-thirds majority felt that the treasury business itself would change post-crisis. It seems there will indeed be a “new normal” for bank treasuries. Banks are looking to rebalance their risk as non-performing loans will have dramatically increased in COVID-impacted sectors such as travel and retail. They will be looking at different industries and regions, and focusing on balance sheet resilience. And they are likely to need faster and more granular tools to get a view of risk that’s even closer to real time. There will be a geographical split in priorities, too: flush with cash injections from central banks, European treasuries will be less concerned about cash management, however it will remain an issue for their Asian and MEA counterparts.

Given concerns over security and infrastructure during the crisis, and the potential for better integration, it would seem that now is a better time than ever for treasury operations to change the way they work. The appetite for a “new normal” is clearly there – and enabling technologies such as cloud now offer the levels of performance and security that are essential.

To see the full results of our survey, see our infographic here.

For more information on how we can help with your treasury requirements, visit our Fusion Treasury page or contact us here.