Exceed expectations in a rapidly changing payments world

Meet rising expectations with agile, configurable payments that enable rapid innovation without added complexity

Unify payments in a single solution

Consolidate all payment rails in one modular hub with single implementation and reduce overhead

Reduce operational complexity

Boost STP and lower operational cost with centralized, out-of-the-box, configurable payment rules

Simplifiy regulatory compliance

Accelerate compliance and reduce operational burden with ISO 20022‑native payments and pre‑certified workflows

Ensure 24/7 availability

A resilient, scalable platform that delivers true availability and peak performance even at high volumes

Customers worldwide trust Global PAYplus

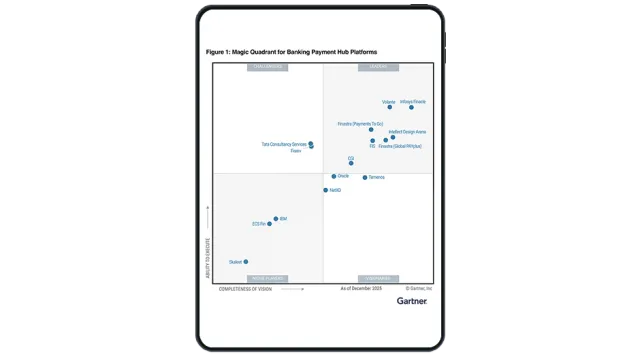

2025 Gartner® Magic Quadrant™ for Banking Payment Hub Platforms

Finastra named as a Leader.

Lead the future of payments with a single solution

Modernize payments without compromise

Global PAYplus is designed to enable leading banks with complex, multi-country operations to modernize their payments infrastructure cost effectively.

Future-proof US ACH payments with Global PAYplus

Find out how Global PAYplus is enabling one of the largest US ACH processor to process 2M ACH payments in less than 30 minutes.

Embracing the future of cross-border payments

Discover how Global PAYplus is enabling banks to meet modern customer's demand for faster, secure, affordable, inclusive, and transparent payment experiences.

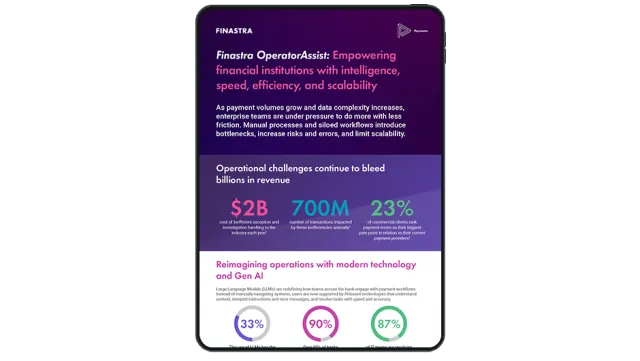

Finastra OperatorAssist

Empowering financial institutions with intelligence, speed, scalability, and efficiency gains of at least 20%.

Instant Payments and Beyond

Find out key technological and strategic imperatives for bank CIOs to capture instant payments opportunities globally.

Team up with a leader in global payments innovation and technology

Helpful resources to improve

Global PAYplus FAQs

Trusted payments hub solution for over 30 years

Learn more about Finastra Global PAYplus multi-rail solution

We selected Finastra’s payment hub as it supports multiple payment types within one standalone system, while enabling seamless integrations of new services as and when we need them. With Finastra’s solution and industry expertise, we will gain the necessary agility required to keep pace with regulatory and industry demands.