Multi-rail payments processing in a single unified solution

Unify mass, high value, real-time, and cross‑border rails in one solution, designed to boost efficiency, reduce complexity, simplify compliance, and accelerate time to market

Reduce operational complexity

Consolidate and manage all payment operations in an out-of-the-box, multi-cloud, ISO 20022-native payments hub

Minimize risk and cost

Pre-certified, configurable business rules, and best practice payment workflows to reduce risky and expensive customizations

Accelerate innovation and growth

Drive payments innovation with seamless cross‑border instant payments, enabling real‑time settlement and frictionless customer experiences

Ensure scale and resilience

Built to handle high‑volume, always‑on payment demands with unmatched scalability and resilience

Expedite time-to-market

Clearing Development Framework and Model Bank Package to rapidly implement new clearing schemes and expand to different geographies

Enhance liquidity control

Built-in liquidity and risk management module to monitor liquidity in real-time on Clearing, Settlement, Nostro, and Vostro accounts

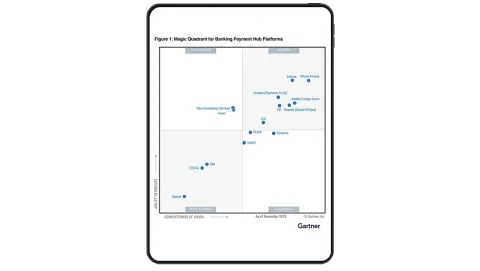

Partner with a leader in global payments innovation and technology

Modernize payments infrastructure

Remove the burden of maintaining legacy payment silos while streamlining workflows and future-proofing your payments business.

Simplify

Minimize complexity with automated payments processing that boosts STP, reduces risk, and speeds up transactions

Flexible

Choose the deployment model that fits your business, offering maximum freedom and scalability

Control

Get complete visibility with dashboards, reporting, and analytics, turning payments data into actionable insights

Orchestrate

Achieve end‑to‑end orchestration with greater control, consistency, and scale

The Global Payments Framework (GPF)

Finastra’s proven and reliable approach to accelerate your modernization journey on your terms.

The GPF is a layered architecture built on a cloud-native, microservices-framework, and API-first technology, offering reusability and reduced total cost of ownership.

Drive better business value

AI-driven payments transformation

Gen AI is reshaping commercial payments by turning complexity into instant, intelligent, and effortless experiences

The future of cross-border payments

Watch this episode as Gareth Lodge, Principal Analyst for Global Payments at Celent; Arun Kini, Managing Director of Payments at Finastra; and Radha Suvarna, Chief Product Officer for Payments at Finastra dive into how regulations and ISO standards pushed banks to modernize.

Finastra OperatorAssist

Unlock end‑to‑end efficiency across payments lifecycle and enhance customer outcomes.

Model Bank Package

A delivery approach that enables financial institutions to implement a pre‑configured, best-practice, and ready-to-use payments solution, helping them minimize regulatory risks, reduce operational costs, and achieve faster time-to-value.

Payments Awards

Spotlight on trusted, field-proven, industry-recognized, and award-winning payments solutions

Helpful resources to improve

Payments Hubs FAQs

Is your payments ecosystem ready for the future of real‑time, digital, crypto, and multi‑rail payments?

Finastra Payment Hubs deliver the agility, speed, and resilience needed for real‑time and next‑gen payments. Reach out today to discover how we can help transform and future‑proof your ecosystem.