Five months ago, on a visit to a bank branch with my kids, I told them to pose so I could take some pictures.

When they asked me why, I told them that by the time they grow up, physical branches likely will not exist, so they’ll need some memorabilia to remember the good old days!

Fast forward to the present, and it looks like my predicted timeline has been accelerated with COVID-19 resulting in the world becoming virtual with almost zero warning.

This enforced adaptation has highlighted that while the digital future was considered to be a ‘some-day’ reality, it is already a ‘now’ and ‘today’s’ reality for Financial Institutions — whether they are ready for it or not.

In this unprecedented environment, from the digital transformation standpoint, how should Financial Services Institutions (FSIs) define their go-forward strategy? Should they change their strategic plans or transform them? Is the difference between the two a subtle one?

I believe FSIs should be fundamentally thinking transformation, and not change.

A crisis like this calls for revolution and not evolution.

The distinction between transformation and change is an important one, and not simply a nuance of words, although synonymously used by many.

Transformation challenges the status-quo and empowers organizations to re-imagine their technology strategy without any boundaries, whereas change management approach drives incrementalism — where status-quo bias is high and the future state relies heavily on tactics that bolt on to existing reality and assumptions.

Today’s speed of digital innovation in financial services is unlike anything I have seen over the last two decades — with the famous old adage of “why fix something if it ain’t broken” being the recipe to die, as fintechs snap on the heels of incumbent FSIs.

Having worked in leadership positions within financial services technology for over 15 years — partnering with global FSIs of all size and scale — it is clear to me that there are multiple factors at play that lead to a conservative and highly pragmatic approach to digital transformation in this industry. These challenges include regulatory, risk-averse attitude, data privacy, security, and legacy systems and practices in place from years of operation and multiple mergers and acquisitions.

However, COVID-19 is now serving to be a major catalyst in forcing firms to transform digitally in order to survive.

While some of the challenges this pandemic has posed are net new and unique (think mass work from home protocols) — the need for companies to innovate and grow to survive in an ever-evolving environment is a not a new concept.

The Sigmoid Curve as it Relates to Digital Transformation:

A classic framework, defined by Charles Handy (known as the ‘management guru’), known as the Sigmoid Curve, illustrates the importance of why digital transformation will play such a key role going forward.

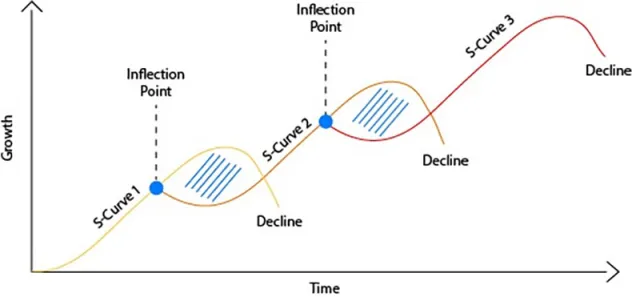

The Sigmoid Curve, an “S” shaped curve (depicted below) represents the cycle of growth, stagnation, and decease.

Whether we look at human or organizational life, we can find existence of a natural cycle of start, growth, maturity, and ultimate decline.

If we study history of organizations or nations, we can see that those who excel are the ones that transform or reinvent themselves before they hit the maturity stage (prime examples — think Amazon and Netflix who’ve succeeded at this, versus Blackberry and Kodak that didn’t).

Example of Sigmoid Curves

The idea almost seems counter-intuitive as many organizations wait to launch their next innovation or take a major leap forward only after revenues start to decline or growth projections start to look troublesome.

After all, when you’re a market leader continuing to grow market share and gain double digit growth, it’s easy to continue your focus on flawless execution.

However, the optimal strategy calls for sustaining that momentum with the recognition that growth will eventually stall, and that every business will face the time when it needs to reinvent itself.

The upward and downward turns in a business occur because of the following:

- Initial growth driven by business momentum is temporary (success is seldom a straight, upward line)

- A business’s own success plants the seeds of its demise (think of the rise and fall of businesses throughout history)

Competitors enter its territory; the once unique idea has now become table stakes, and challengers are laser focused on winning its top customers with their own customer-centric solutions.

Under these dynamics, the only way for businesses continue to win is by defining their new game, and the game thereafter; or they are left to ultimately die down.

The essence of such phenomena calls for FSIs to hit a pause button to seriously question whether they are embarking on a journey of ‘digital transformation’ or ‘digital change’ and what is at stake for their future outlook under each scenario?

The figure above shows, for a business to sustain its growth and market leadership, it needs to think in terms of multiple S-curves, not one.

The ideal time to launch a new S-curve is prior to hitting the maturity stage, while you are still on the upward trend — not when you are on a downward spiral.

The ‘when’ in this case is the game changer vs the ‘how’ and the ‘what’ which should no-doubt be top of mind as well.

Covid-19 has accentuated this challenge for a lot of organizations out there including financial services organizations globally.

However, are incumbent FSIs embracing opportunities presented by digital transformation to launch their next S-curve to expand their customer base, drive higher efficiency ratios, and launch innovative products and services to better serve their customers…. or are they following a risk-averse approach and headed down the path of incremental tactics?

Conclusion

There is an important lesson for FSIs that have been reluctant to change and adapt to the calling from the future that COVID-19 has highlighted — and organizations who don’t react swiftly run the real risk of being left behind.

While there exists much concern and reasons for hesitation, such as data security, privacy, customer risk, etc, with technological advancements such as Cloud, Advanced Analytics, Robotics Process Automation, to mention a few, many of these challenges have been solved and technological advancements continue to improve.

Hence, FSIs need to, now more than ever, direct their focus outward, to prioritize better serving their customer wants, so that they can remain competitive, relevant, and come out as winners with a sustainable recovery from COVID-19.

The future is here, now.

So, focus on transformation — not change.

That really is the name of the game!