Every day we’re seeing more and more banks across the world take a strategic decision to migrate to cloud services. But if we ask them what barriers they anticipate along the way, compliance with regulations almost always comes top of the list.

It’s an important consideration, but the reality is that banks’ operating environment and clients are now moving faster than they can possibly keep up with using on-premise infrastructures.

Three key messages

It’s against this background that we recently hosted an in-depth webinar on cloud regulation in Europe. The session featured expert speakers from the banking and cloud provider communities and was attended by many of Europe’s leading financial institutions. Looking across the presentations and feedback from attendees, three messages came across loud and clear:

- First, whatever the concerns, core banking is moving to the cloud over the next few years

- Second, regulators in Europe and elsewhere have now removed the “barriers” to banks putting core services into the cloud – but the industry hasn’t yet fully recognized this shift

- Third, leading banks are already making strong headway into the cloud, and the laggards are starting to be left behind.

Mapping out migration

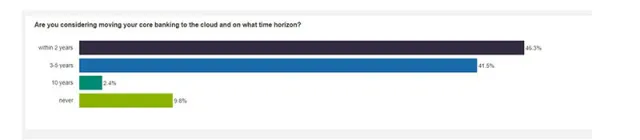

All three themes were underlined by our recent survey of financial institutions. The first poll confirmed that the momentum behind the move to cloud is now unstoppable. Asked whether they were considering moving their core banking to the cloud and, if so, when, almost half (46%) of the banks participating in the session said they were looking to migrate within two years. Only 12% put the timeframe at 10 years or never.

It’s easy to see what’s driving this migration. Banks are already finding that the well-known benefits of cloud – such as access to massive computing resources on-demand and pay-per-use pricing – are just the start. Among other advantages, cloud is also freeing up resources through lower costs, dramatically accelerating speed to market, and acting as an engine for front-office innovation.

No more regulatory barriers

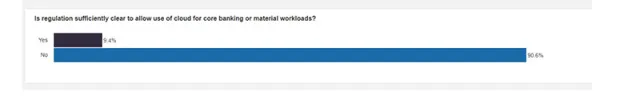

So, the migration’s underway. And our second poll zeroed in on whether banks think cloud regulation is an enabler or barrier to this journey, asking whether current regulation is sufficiently clear to allow the use of cloud for core banking or material workloads. Over 90% responded that regulation is not clear enough to put core banking in the cloud, with less than one in 10 expressing the view that it is sufficiently clear.

As we subsequently heard during the webinar, this perception of regulation as a barrier is both widely-held – and also out of date. The clear signal now coming from regulators is that the blockers on moving core banking to the cloud have been removed, and that banks are free to use cloud for whatever workloads they choose. This opening-up has been supported by strengthening relationships between regulators and leading global cloud providers.

The pandemic has spurred digital acceleration

We then turned to the state of play on cloud in banks themselves. Given added urgency from COVID-19, banks digitization programs are advancing apace – including cloud. Asked what kinds of workload they’re now running on public cloud, almost one-third of our webinar participants said core banking workloads, with the rest split fairly evenly between non-material production workloads, non-production workloads, and no use of cloud at all.

What’s clear is that some leaders are advancing on their journey to cloud, while a substantial proportion have yet to start. While complying with the regulations around cloud – especially GDPR – demands work, the effort is far outweighed by the benefits. Cloud’s time has come, and banks that fail to seize the opportunity now will face a struggle to catch up. Put simply, there’s no time to lose.

To find out more about Finastra’s cloud payment solution, visit the Fusion Payments To Go page.

#PaymentsMadeEasy