Transform Lending with GenAI

Discover how banks are leveraging Generative AI to reshape lending, drive efficiency, and enhance customer experiences.

Digital loan origination modules that ensure accuracy and accelerate underwriting

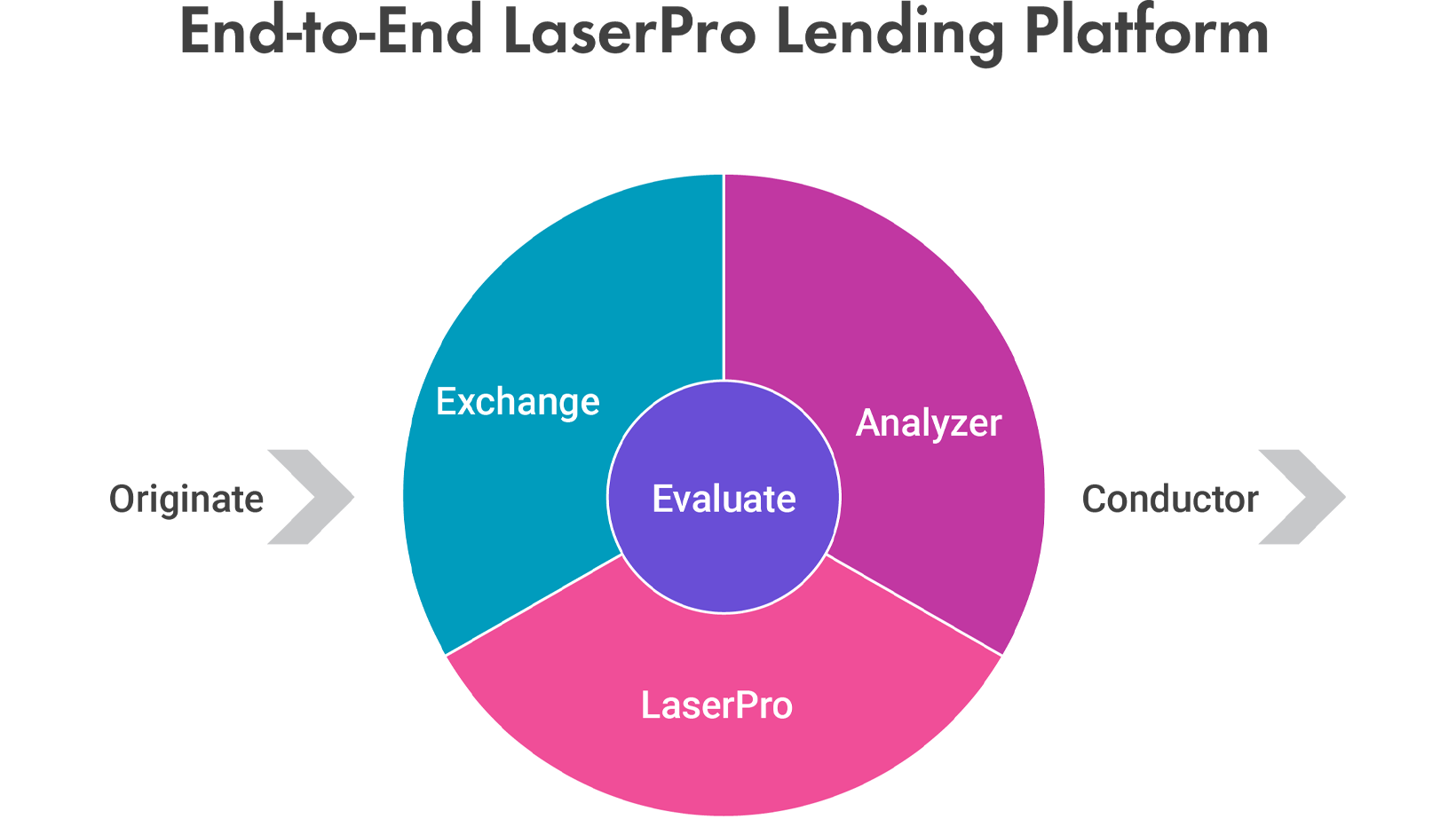

Finastra's digital LaserPro Lending Platform seamlessly moves loan applications to closing by integrating statement handling, financial analysis, relationship management, compliance, and closing documentation into a unified digital experience, enhancing operational efficiency and reducing manual workflows.

Integrated commercial origination and processing system

Streamline business loan workflows, reducing manual effort and accelerating approvals.

Cloud-native solution designed for continuous innovation

Secure and seamless updates leveraging AI, analytics, and third-party integrations.

Unified lending experience

By eliminating silos and manual handoffs, LaserPro Lending Platform provides a seamless end-to-end lending experience

Supports modular deployment

Analyzer, Exchange, Evaluate and LaserPro cloud can be used individually or together. Scale capabilities as your business evolves without costly investments.

LaserPro Lending Platform – a consistent processing experience

Streamline loan origination, drive operational efficiency, accelerate credit evaluation, and improve decisioning for faster approvals using the LaserPro Lending Platform. Within the platform LaserPro Evaluate unifies the lending origination processes into a seamlessly integrated holistic digital experience.

LaserPro Lending Platform solution modules offer the benefits of a fully-integrated and fully-digital origination experience

LaserPro Evaluate

Streamlines loan workflows, reduces manual effort and coordinates each LaserPro Lending Platform module. It integrates with LaserPro cloud to efficiently move loans through documentation to closing.

LaserPro Exchange

A modern online platform to request, upload, and share any needed files throughout the entire loan process, which accelerates loan preparation and closing and enhances the customer experience.

LaserPro Analyzer

LaserPro Analyzer accelerates the statement spreading process while introducing rigorous controls that ensure consistent, accurate, and reliable financial analysis.

LaserPro cloud

The industry-leading compliant loan document engine features a fully-digital, end-to-end workflow that helps financial institutions manage costs while streamlining the lending process from origination and processing to closing document preparation and delivery.

Streamline your lending process using Finastra LaserPro

-

Finastra LaserPro

-

Finastra MortgagebotLOS

All-in-one secure loan origination system that supports retail, wholesale and correspondent mortgage lending

-

Finastra LaserPro Conductor

Transform loan document review and approval

-

Finastra Originate Business Loans and Deposits

Navigating the current (and future) mortgage market

Find out how we can help