Nothing is more fundamental to poverty reduction than employment

Finding a way to bridge the $5.2 trillion SME funding gap has proved a complex and multi-faceted problem. Global efforts to reduce the 1.7 billion un/underbanked around the world have achieved some success, but access to financial services is a single part of a much more intricate problem.

Yet, the growth in digital infrastructure around the world has created an unparalleled opportunity for microfinance institutions (MFIs) to grow and flourish, in turn supporting the flow of funding to the crucial SME sector, the foundation for the world’s economy.

Finastra’s vision is to harness emerging digital innovations to meet the needs and expectation of individuals and small and micro- enterprise, and boost microfinance opportunities for diversification and growth, to reduce the funding gap by 1% in each country that we approach.

Sustainable microfinance: Beyond basic financial services

Through our commitment to ESG and firsthand experience of financial behavior in developing countries, we know that creating the conditions for sustainable progress requires a different approach. One that looks beyond financial access to the myriad factors that inhibit economic empowerment; emotional issues such as financial sentience, practical issues such as the scarcity of specific data, and macro issues such as perceived risk and corrupt practices.

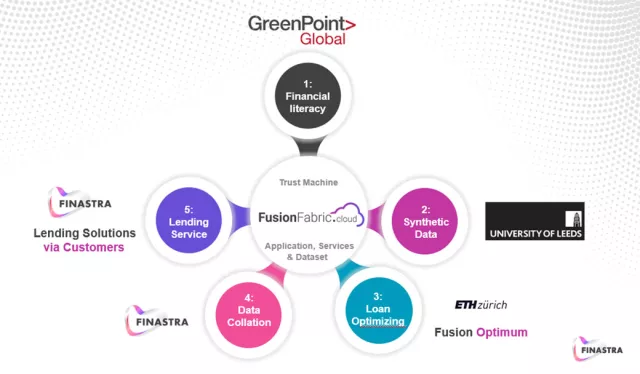

To bridge the gap, a holistic approach to microfinance that includes better modelling and risk forecasting, financial education as well as financial services, and the synchronization of balance sheets of both the borrower and the lender, is required. That is Trust Machine.

Meet the ecosystem

We approached the barriers to economic empowerment systematically – data scarcity, modelling inadequacies, financial illiteracy and a lack of funding transparency – and collaborated with experts renowned for their success in technology and ESG performance. Our forward-thinking ecosystem comprises leaders in the field of financial literacy, technology, synthetic data generation

GreenPoint Financial – Literacy: A high-tech online learning platform for students, parents and borrowers, GreenPoint delivers financial education in all possible languages and locations, to encourage peer-to-peer dialogues between financial institutions and the local population.

Fusion Optimum (with University of Leeds and ETH Zurich) – Optimal loan product and pricing: Statistics experts use advanced algorithms to determine the optimal products and pricing that satisfy both borrower and lender, across the entire funding chain, using inputs from hundreds of constraints, variables and goals, for a new credit risk approach.

University of Leeds and Straterix – Country/business risk and advanced scenario modelling: MFIs can now access advanced data modelling to ascertain the risks of investing in specific countries or sectors. Synthetic data creates market modelling precision, augmented by the capabilities of specialist fintech Straterix which generates up to 10,000 scenarios, for superior risk analytics.

FusionFabric.cloud – Open platform the digitization of lending process: Via our open platform, we can deliver lending apps “as-a-service” capable of digitizing the process in even the most remote locations. If local financial partners can’t afford to manage their full IT services, this tailored, low-touch lending service provides all of the functionality out-of-the-box.

Collectively, the approach creates the optimal conditions for both borrower – through long-term financial education, a more informed view of business management and affordable loans – and lender – through revenue opportunities, better risk analytic and the ability to create tailored, affordable products conforming to risk parameters.

A model scaled for impact and job creation

As well as boosting the SME sector, our model creates the opportunity for fintechs to ‘localize’ components and build business lending apps – generalist or aligned with specific outcomes such as empowering women or delivering grants focused on achieving UN SDGs; healthcare, energy and more.

We have one common goal - to reduce the funding gap by at least 1% in each and every country that we approach, starting with a pilot in Kenya.

Banks & institutions

Access affordable, tailored loan optimization products to improve the flow of SME funding

Partner with us

Add your expertise to our ecosystem, regionally or globally, to boost microfinance effectiveness

Fintech opportunities

Build and localize your microfinance app using our solution and open APIs

Local partner

Accelerate microfinance success in your region and become part of global progress