Finding the Opportunity in Business Banking

With more than 30 million businesses across the country, Community Banks and Credit Unions look to bring the perfect balance of digital experiences and personal service to local business owners.

Rooted in community, Small and Mid-size businesses (SMBs) seek advice and guidance from their local financial institutions. They need to be prepared to offer the same level of digital banking technology SMBs can easily get from larger nationwide providers.

Small Business Banking Proves to Be a Fit for Community Banks and Credit Unions Looking to Gain a Specialty Banking Edge

Small and mid-sized businesses account for 99% of all business activity in the United States. And with those businesses counting on customers to shop small and shop local, it’s a perfect fit for community banks and credit unions to meet their needs. Traditionally smaller banks and credit unions focus on relationship building and gaining an in-depth understanding of their business owner clients and members. But as these account holders and borrowers look for the perfect balance between home town values and cutting edge technology, community financial institutions will need to sharpen their specialty banking edge to remain competitive.

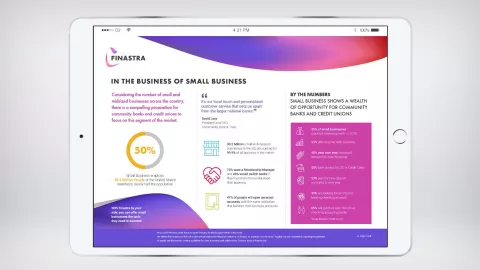

By the Numbers: Business Banking Means Big Business for Banks and Credit Unions

At one time, offering financial services to small businesses was a cumbersome task that was fraught with custom technology needs and manual regulatory oversight. But with the right financial technology partner for their business banking strategy, commercial banks and credit unions can meet the client or member need by keeping their back office in order.

Knowledge Center

Solutions

Finastra Solutions for Business Banking

Solutions

We Have You Covered

With North American headquarters based in Lake Mary, Florida, Finastra has a solid and deep presence in community markets.

Our clients in the region benefit from dedicated employees located across the country to provide community banks and credit unions with innovative, proven financial software solutions. The region’s 4,200+ clients can be found far and wide, from Key West, Florida to Hobbs, New Mexico; Willards, Maryland to Honolulu, Hawaii; Fremont, Ohio to Fort Collins, Colorado; and everywhere in between.

Do You Want to Know More About Our Solutions?