Reshaping the Customer Experience Using Next-Generation Banking in the Cloud

Today’s consumers and SMEs expect banking services that are fast, functional and intuitive.

Consumer expectations are moving fast, as bank customers demand a highly personalized experience. The result is a perfect storm: a generational technology shift, a rapid change in what customers want and the arrival of new players and new business models.

Helpful Resources

Solutions

Drive Superior Digital Customer Engagement with Fusion Essence Cloud

Fusion Essence Cloud helps challenger banks and SME lenders on-board customers faster, launch new products and services ahead of the competition, and deliver banking exactly as they expect it.

Next Gen Banking Experience

Unlock

40% of consumers state that experience is the most important factor when opening or closing an account. Consumers and SMEs are increasingly expecting better service and more personalised services, built around their needs and lifestyle.

Innovate

Open banking is now the de-facto standard for banks globally. It unlocks opportunities for banks to develop new services and add value by empowering their customers to quickly understand their financial position, explore alternatives and make better financial decisions.

Accelerate

Today success depends on agility, the top priority for challenger banks is to rapidly build scale, attract customers, and increase share of wallet.

Unlock Customer Centricity

What makes a happy customer?

Today’s consumers – me, you – are on-the-go. We live fast-paced lives, and the services we use reflect this. We want technology not for technology’s sake, but because it makes our lives easier, helps us move faster and allows us to achieve more each day.

With the world around us digitally transforming at a rapid pace, the opportunity to deliver value-adding financial products and services has never been greater.

Here are three steps to delivering banking services, exactly as your customers expect them:

- Launch fast. New ideas – we all have them, but we don’t all act on them.

- On-board seamlessly. Capturing business relies on more than just the idea.

- Design and deliver new products that WOW your users. Converting a potential customer into a real customer is hard.

Banks are re-evaluating their services and operating models

Solutions

Open Banking and Innovation

Fintech or Bank? Technology is changing banking.

Only 26% of banks feel ready for Open Banking Platform makes possible previously unachievable level of service, collaboration and innovation. Combined with core solutions that have an open architecture and open APIs, it enables the quick extension of a bank’s ecosystem , providing new opportunities for revenue growth.

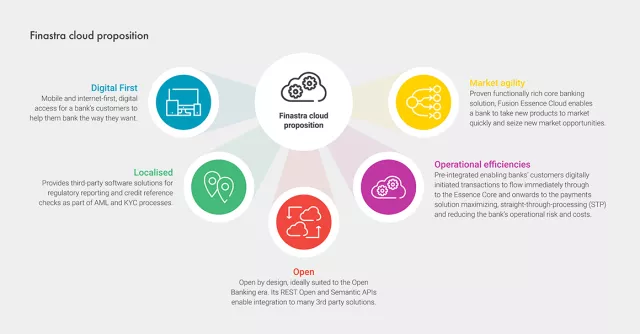

Fusion Essence in the cloud is a fully integrated core and digital solution. Deployed on Azure, Microsoft’s enterprise-ready, trusted cloud platform, it is particularly suited to ambitious challenger banks, enabling them to come to market with velocity, allowing them to launch personalized offerings first and fast, maintaining a competitive edge.

To learn more about the transformation to a platform ecosystem, discover new apps on our open platform, or to start your evolution, head to fusionfabric.cloud or read Finastra's latest report.

Solutions

Accelerate Business Growth

Today success depends on agility.

Agility, speed to market and customer conversions are all essential. Open APIs enable the creation of new ecosystems, as well as collaboration with other banks and third parties, turbocharging new opportunities for revenue growth.

For new banks entering the marketplace, the only way is cloud. Finastra’s Fusion Essence is a cloud- enabled solution that covers conventional Islamic Retail and SME banking. Recent successes in Europe and Asia-Pacific are proof that Fusion Essence Cloud has the agility, flexibility and security that challenger banks need, no matter where they operate.

Fusion Essence Cloud is a next-generation core banking platform which frees banks from the burden of IT operations with a pay-as-you-go subscription model. The solution covers UK core and digital banking requirements, including lending, digitally originated deposits, payments and regulatory reporting. An accelerated onboarding approach enables banks to launch first and, importantly, to drive fast customer adoption and business growth once live.

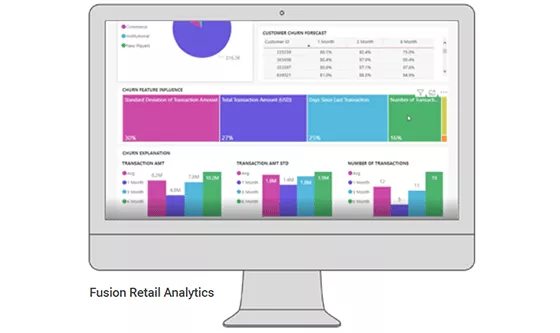

It includes additional optional components such as Teller, and Analytics using Microsoft’s Power BI, unlocking valuable insights giving banks a data-drive competitive advantage.

Hear it From Our Customers

TONIK Financial Pte Ltd is the first licensed digital-only bank in Southeast Asia, on a mission to revolutionize the way money works in the region. Fusion Essence Cloud will be deployed out of the Microsoft Azure Southeast Asia Region (Singapore Data Center), which enables low latency and data residency. TONIK will benefit from a low cost of entry into the market, ease and speed of deployment, and the ability to increase business volumes and diversify its product set cost effectively. It will also benefit from ongoing software updates and access to further innovation via FusionFabric.cloud, Finatra's platform for open innovation and collaboration.

New SME focused bank selects Fusion Essence in the cloud to power end-to-end digital banking and lending services.

Tim Brooke, Chairman of Gravity said, “Small businesses in the UK continue to struggle when it comes to choosing a bank that can support their needs. Traditional banks are failing to keep up with the agility these firms require and instead restrict their access to capital, stifle them with bureaucracy, and provide little or no support. By partnering with Fusion Essence in the cloud we will bring to market an agile, customer-oriented service that will make business banking fairer and simpler. We believe that Finastra is the trusted provider we need to support our ambitious plans for growth.”

Fusion Essence in the Cloud

Fusion Essence in the cloud gives ambitious challengers the velocity to launch first and fast. It can be implemented quickly, and delivers the agility for fast time-to-market, driving rapid growth while reducing your TCO.

Retail Banking Overview

Do You Want to Learn More About Our Solutions?