‘Open’ puts innovation in the hands of our customers

When 95% of innovation happens outside of your own walls, it’s key that you have the technology, tools and expert ecosystem to grow and succeed.

We serve ~8,100 financial institutions, providing the broadest, deepest software applications and connectivity to marketplaces, partners and fintechs through our open platform, orchestrating the future of financial services.

Largest pure-play FS software company

Transformative: Digital, Cloud, Banking as a Service

#1 open platform in financial services

Serving institutions of all sizes across 130+ countries

Award winning platform & software applications

Purpose-led to redefine finance for good

The latest from Finastra

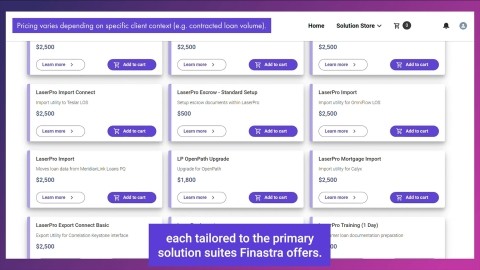

Solutions

Finastra at a glance

Of the world’s top banks

Fintech apps connected

Customers, from global banks to credit unions

Employees in R&D

A company committed to open in all its forms

Our open, collaborative culture helps us redefine finance for good; uniting technology, people and businesses to bridge the SME funding gap, boost financial inclusion, eradicate bias from AI and tackle inequality.

Find out more about the company behind open finance